Customer churn is a reality that spares no one, no matter the size of the company.

Of course, the percentage varies but the average churn rate across industries is typically around 10-30%.

So, businesses need to pay utmost attention to their customer churn rate and evaluate and understand why certain percentages of customers abandoned their ship and find a new solution instead of yours.

Okay, so you might be facing the issue of customer churn but you must be wondering if it is really that important, and if so then what is the solution?

Well, with this guide you will understand what customer churn is, why it is important for businesses to do customer churn analysis and finally learn 7 simple ways you can reduce your customer churn rate with an efficient customer feedback platform.

What is Customer Churn?

Customer churn refers to the percentage of customers who discontinue their business or end their relationship with a company during a specific timeframe. In simpler terms, it represents any loss of business.

Customers may leave for various reasons, but poor customer service and dissatisfaction with the product or service are significant factors.

To better understand customer churn, let’s consider an example from the telecom industry.

In this industry, numerous companies compete by offering different services, each striving to outdo the others.

Suppose you acquired 2000 new customers in a year, but you also lost 300 customers due to reasons like inadequate customer service, customers finding better alternatives elsewhere, or confusing terms and conditions. This means that within one year, you lost 15% of the customers you initially acquired.

Considering that the telecom industry typically experiences an average churn rate of 15-25%, it becomes even more crucial for companies in this industry to prioritize customer retention.

Acquiring new customers is costly, typically costing 5-7 times more than retaining existing ones. Thus, strategies to reduce customer churn and improve customer satisfaction and loyalty are vital for long-term success.

But why is the Customer Churn Rate truly important? Let’s delve deeper into the matter to understand its significance.

Why is Customer Churn Rate Important?

Did you know that there is more than a 25% increase in profit if a company increases customer retention by 5%?

Let this sink in for a moment.

This statistic alone emphasizes the significance of focusing on customer retention rather than solely concentrating on customer acquisition.

To further explore the significance of customer churn rate, take into account the following factors:

1. Market Reputation

Let’s say you used a product from a beauty brand, loved it, and shared it with your friends and relatives, encouraging them to use it as well. Your peers used the product and also loved it and recommended their friends to use it too.

So, the cycle will increase which will not only increase the company’s revenue but will also help them maintain their reputation in a competitive market. Now, imagine a reverse scenario where the product is bad and customers are leaving dissatisfied and frustrated.

A high customer churn can reflect negatively on a company’s reputation. In today’s connected world, dissatisfied customers can share their experiences widely through social media, online reviews, and word-of-mouth.

This can deter potential customers from choosing the business which will not only affect the company’s profitability but also its reputation.

2. Customer Feedback and Improvement

Tracking customer feedback provides valuable insights into the reasons why customers leave. By analyzing the churn data and feedback, businesses can identify patterns and issues in their products, services, or customer experience.

“According to a survey by PwC, 32% of customers say they will stop doing business with a brand after just one bad experience.”

So, understanding your churn pattern will help you in making necessary improvements to enhance your customer satisfaction and retention.

Collect Valuable Insights from Feedback!

3. Competitive Advantage

Let’s say you have an e-commerce business, and your customer churn rate was between 15-20% in the first few years. Then you decide to look into the issue, do a churn analysis, and strategize your business to reduce churn.

By effectively managing churn, you gain an edge over your competitors. While they may still be struggling to acquire new customers, you already have a loyal customer base who are satisfied with your products and services.

This gives you a head start in terms of revenue generation and customer loyalty.

Having a lower churn rate acts as a competitive advantage because businesses that excel in customer retention stand out from their competitors.

By nurturing long-term, satisfied customers, you create a strong foundation for your business. These loyal customers are more likely to become brand advocates and refer others, contributing to organic growth and further solidifying your competitive position in the market.

4. Revenue Impact

According to a report by Deloitte, the churn rate for subscription video streaming services in the United States was around 37% in 2022. This means that, on average, 37% of subscribers canceled their subscriptions within a year.

This proves that customer churn directly affects a company’s revenue as losing customers means lost recurring business, reduced sales, and potential impact on profitability.

By understanding and managing churn, businesses can focus on retaining customers and minimizing revenue loss.

5. Growth and Business Planning

Market competition is a big challenge for any business, especially a new business trying to establish itself in the market. The survival of the company depends on its ability to retain as many customers as it can as that would result in revenue generation and profitability.

This is where customer churn rate becomes an important tool. It helps businesses in knowing how many customers they are losing and why.

It helps businesses in forecasting business growth and planning strategies. By understanding churn patterns, businesses, especially early-stage businesses, can accurately predict customer attrition, assess market demand, set realistic growth targets, and align their resources accordingly.

Monitoring and managing customer churn rate is vital for businesses as it directly impacts revenue, profitability, customer acquisition costs, and long-term growth. By reducing churn, businesses can foster customer loyalty, strengthen their market position, and ultimately thrive in a competitive landscape.

How do you Calculate the Customer Churn Rate?

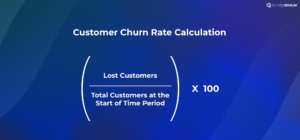

To calculate the customer churn rate, you need only two pieces of information:

- Number of customers lost in a specific period of time

- Total no. of customers at the beginning of the specific period of time

To put it into the calculation, you would need to figure out a time period and the number of customers who left during that time period, divided by the number of customers at the beginning of that time period, multiplied by 100%.

Let’s say you started the month with 100 customers (to make it simpler) but lost 5. Then, using the above formula would bring your churn rate to 5%.

Simple right?

As simple as this might seem to be, being able to calculate and keep track of the churn rate would be important to assess how your business, campaigns, various projects, etc., are performing.

While the actual result (5%) might not seem to show much, it lets you dig deeper into the root cause and make appropriate changes.

Customer Churn Analysis

Customer churn analysis is defined as the process of examining customer churn patterns and identifying factors that contribute to customer churn.

It involves analyzing customer data to gain insights into why customers leave and developing strategies to reduce churn rates.

Here are the 3 simple steps so you can perform customer churn analysis.

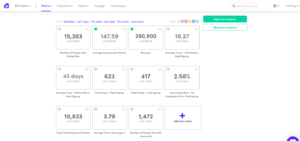

STEP 1: Harness the power of subscription analytics

Invest in robust subscription analytics tools or platforms that can help you gather and analyze valuable customer data.

For example, using tools like Mixpanel, Kissmetrics, or Google Analytics can provide you with insights into customer behavior, engagement metrics, and retention rates.

STEP 2: Dive into customer segmentation

Segment your customer base based on relevant criteria to gain a deeper understanding of different customer groups.

For instance, you can segment customers by demographics (age, location, gender), purchase behavior (frequency, average order value), or engagement levels (active users, dormant users).

This customer segmentation allows you to identify trends and patterns specific to each group.

STEP 3: Identify churn types and take targeted action

Analyze the churned customers within each segment to identify the specific types of churn occurring.

For example, you may find that one segment experiences higher churn due to pricing concerns, while another segment churns due to poor user experience. By pinpointing the churn types, you can tailor your actions to address the root causes and minimize churn.

However, analysis of why customers are leaving you is not enough in itself. You need to work on the reasons you find, resolve those issues, and inform them of the solutions taken. This will show your customers how committed you are to improving their experience.

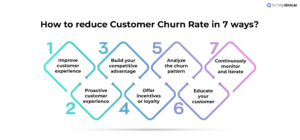

How do you Reduce Customer Churn Rate in 7 Simple Ways?

Now that we know what customer churn is and why it is important, let’s understand how to reduce customer churn rate in 7 simple ways.

1. Improve Customer Experience

Let’s say you purchased a flower vase from some e-commerce website but it was damaged and you put it in for return but the return kept getting delayed so you contacted customer support but they are of no help.

So, after weeks of complaining your return is finally processed. Do you think you will make a purchase from this same website again? No, right?

So what happened in the above scenario? The website acquired a new customer but lost it due to its poor and slow customer service. This is why it is essential for businesses to make sure that they are providing the best customer service experience possible.

As we understood from the above scenario, improving your overall customer experience can be a big move in reducing customer churn rate. You can do this by tracking your Customer Effort Score. The lower the score better your customer service.

The same can be seen in the case of Allianz, a financial service company, who faced an issue with their customer feedback platform which was resulting in a high customer complaint rate.

They used SurveySensum as their customer feedback platform for easy reporting, text analysis, and unlimited responses. This helped them in gathering customer feedback in real-time and reduce their customer complaint rate by 23% which ultimately reduced their customer churn rate.

Improve your Customer Experience with SurveySensum

2. Proactive Customer Engagement

Engaging with your customers proactively helps build stronger relationships. To do that communicate with your customers regularly through personalized messages, targeted offers, and relevant content.

For example, here is one of the emails from Audible to sign up for the Audible Challenge 2020 which is to the point, clear and concise. This email will make the current customers intrigued which will keep them engaged with the product.

Whether it is social media, emails, calls, or chats, whichever channels your customers use, your business should be proactive in reaching out and also addressing their queries in no time.

3. Build your competitive advantage

Have you heard of ActiveCampaign? Some of you might have heard it, some of you might not have. But you must have heard of Hubspot, right? Both of them provide CRM services to businesses, then why is it that one is more popular than the other?

HubSpot and ActiveCampaign might offer similar products but most people might not be aware of ActiveCampaign. That’s because of the thought leadership content and free academy courses HubSpot offers.

It shows them as a leader in their industry which in turn helps them earn trust by setting them apart.

With the free content HubSpot offers, it brings them in front of the customer’s mind and increases word of mouth. Build that competitive advantage to contribute to higher profit, and loyalty and increase customers.

If you are competing with some big brands and want to establish yourself as a strong competitor, then look for the gaps. Look what the brands are not doing.

Like in the example of Hubspot, they started making knowledge accessible for everyone who came to their platform which is something no other brand was doing at that point. So, set yourself apart from the rest to build a competitive advantage over them.

4. Offer incentive or loyalty

Implementing loyalty programs or reward systems to incentivize customers can really help you increase your customer loyalty and reduce your churn rate.

Providing your long-term customers as well as new customers with customized rewards or offers will definitely make them feel appreciated. With constant engagement through new offers and discounts customers will keep on interacting with your business.

Loyalty programs are not new concepts. Many big companies like Sephora, and Starbucks have popular loyalty programs where they give rewards, discounts, and points to their loyal customers. In 2019, 45% of the total sales of Sephora came from their loyalty programs.

You can start it with something as simple as a points-based program where your customers get points each time they make a purchase. The points can either convert to discounts on their next purchase or help them become a member which will again have other benefits to it.

5. Analyze Churn Pattern

We have talked about what customer churn rate is, why it is important, how to calculate it, and the steps to do a churn analysis but is that enough? You need to implement those strategies, right? But is that still enough?

Implementing new strategies and improving your current strategies might not be enough, you need to analyze your churn pattern to identify common reasons for attrition.

Look for specific triggers like product issues, pricing concerts, customer service, etc., and use these insights to make targeted improvements and address the root causes of churn.

This analysis involves defining what constitutes a churn for your business, collecting relevant data, dividing your customers into different segments, identifying churn indicators, analyzing your customer journey, analyzing customer feedback, and developing actionable strategies.

Analyze Churn Patterns Effectively!

6. Educate your Customers

It might have happened to you too. You purchased an item online, it looked simple enough to use in the sample videos but when you received the product it looked very complicated, and even after many tries you could not make it work and decide to return it or throw it away.

That situation will definitely make you frustrated with the brand and you might even discontinue it resulting in customer attrition for the company. This could have been avoided through a simple handbook or video tutorial.

This shows that sometimes your customers might not be fully aware of the benefits, features, and potential of your product or service, so educate your customers about your product or service. Offer free tutorials, webinars, and other knowledge bases to make sure that your customers fully understand how to utilize what you are offering.

7. Continuously monitor and iterate

Whenever strategies are implemented for any kind of business it is not guaranteed that they will work, right? The same goes for all the above-mentioned strategies. They won’t matter if you don’t keep track and monitor the strategies that you implement.

Some of the strategies might be failing or backfiring. Some might be giving you huge success but if you don’t track and evaluate them then all the hard work will be in vain.

Regularly monitor churn rates, customer feedback, and the impact of implemented strategies. Iterate your approach based on data-driven insights and feedback to optimize your churn reduction efforts over time.

Conclusion

In conclusion, Customer Churn is an important metric that directly impacts the success and growth of your business. A high customer churn rate can lead to revenue loss, reduced customer base, and increased acquisition costs.

However, it is very much possible to reduce your customer churn rate by understanding the factors that contribute to churn and implementing effective strategies to reduce it. This will help businesses to improve their customer retention, enhance profitability, and foster long-term customer relationships.