Did you know that banks that practice customer experience optimization grow 3.2 times faster than their competitors?

This shift in customer experience – from being “just enough” to “wowing customers” has taken the CX industry by storm and banking and financial services are not indifferent to it. Customers are no longer just expecting a good enough experience, they want their banks to exceed their expectations.

In an industry that is built on trust and reliability, delivering a positive and memorable customer experience will help you maintain that trust, build strong relationships, and drive growth. Now, to create these experiences, it is also important to keep up with the current trend. So, let’s discuss the top customer experience trends in the banking industry that you can implement for your organization.

Top 6 Customer Experience Trends In Banking Industry To Follow

Keeping up to date with the current trends in customer experience will help you tap into current customer expectations and bridge the gap between your current offerings and customer’s expectations.

So, let’s discover some of these top-trending best practices and strategies.

1. Migration of Customers Towards Digital

A recent survey by McKinsey revealed that digital interaction in banking has grown by 40% in the past few years. This shift towards digital isn’t just a trend – it’s a transformation of the banking industry.

50-70% of customers now prefer digital banking services to manage their finances because they offer convenience, speed, and efficiency. Customers also expect 24/7 omnichannel access to customer support ranging from call centers to chatbot tools, which has encouraged banks to invest heavily in digital infrastructures and technical integrations to support this operational advancement. In fact, the global digital banking market size is expected to grow at a CAGR of 8.3% from 2021 to 2028.

This means that banking and financial organizations need to migrate and enhance their digital customer experience with continuous improvements like omnichannel customer interactions, AI-assisted chatbots, customer data integration across channels, etc. By implementing these practices and upgrading operational activities while ensuring compliance with KYC rules for banks, financial institutions can meet and exceed the rising customer expectations of their customers, offering them personalized services, convenience, and enhanced security and accessibility.

2. AI for Risk Management

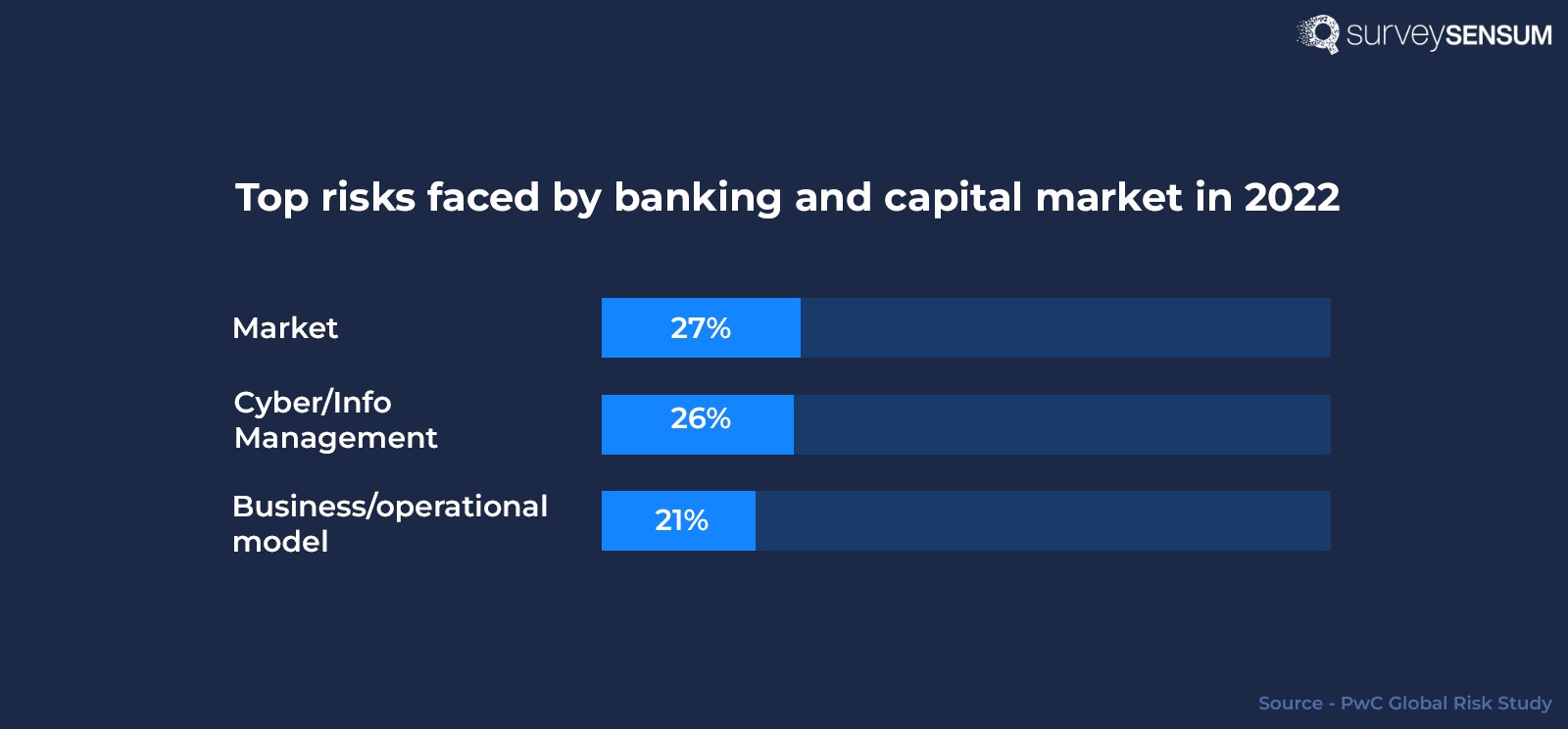

Just like changes and enhancements in customer interactions, banks, and banking institutions also need to be prepared for different types of risks. And according to PwC Global Risk Study, these risks include market risks (27%), data management risks (26%), operational risks (21%), and credit risks (20%). With the new age descending, risk management also needs an upgrade to sustain these changing times.

The use of AI will be more prevalent in the future when it comes to managing risks and enhancing risk management in banking. Here’s how it can be helpful:

- Fraud detection and prevention: AI algorithms process thousands of customer interactions every day, spotting unusual patterns, behavior, and even fraudulent activities.

- Credit risk assessment: AI improves credit risk management by evaluating the creditworthiness of customers by not only assessing traditional data but also alternative data like spending patterns, social media activities, and geolocation.

- Anti-money laundering: Machine learning models analyze thousands of transactions looking for complex patterns, and flagging irregularities like unusual activities or connections to high-risk entities. Additionally, the implementation of machine learning in finance is transforming how institutions handle vast datasets. AML solutions like iDenfy or other solutions provide more accurate predictions, real-time risk assessments, and enhanced decision-making.

3. Personalization But With A Twist Of AI

Every CX strategy includes personalization. Everyone’s talking about it. However, sending a birthday message or offering personalized discounts isn’t going to cut it anymore.

According to Mastercard’s Guide to Personalization in Financial Institutions, 86% of financial organizations state that personalization is a clear and visible priority for their companies and digital strategy, with 92% planning to invest further into this.

Customers now want their banks to understand their interactions and tailor their journey and offerings accordingly. Calling customers to offer loans and credit cards is just not enough! Banks need to see customers as a whole, observe and understand their journeys on all channels, and offer personalized services that are relevant to their past interactions.

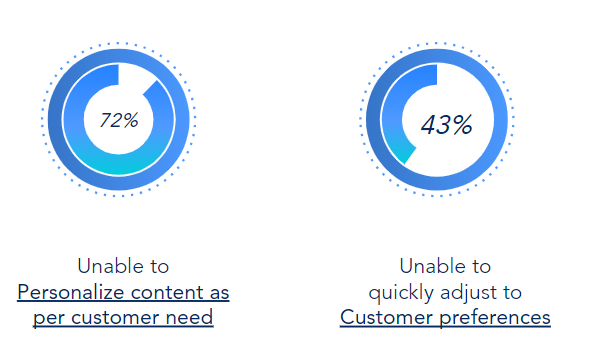

However, as per the State of CX in India report, 72% of businesses struggle to personalize content according to customer needs and 43% of companies find it challenging to quickly adapt to changing customer preferences.

So, in order to make a mark in this era of personalization, banks must utilize comprehensive customer data – from developing unified customer profiles, keeping CRM records up-to-date and accessible on all channels, and maintaining a real-time view of customer transactions and historical trends.

These practices will enable you to create a personalized experience for your customers based on their journey, as well as a seamless experience across all channels, because it is not just about delivering the right product anymore, creating an intuitive financial journey for your customers.

4. Make Your Customer Experience Omnichannel

Imagine going to your bank after two years, a bank you have been a part of for 7 years, for an urgent deposit and receiving a “Welcome to the tribe!” message – not done!!! For a seamless and secure omnichannel experience, integrating age verification software ensures that all digital touchpoints comply with necessary regulations.

In this digital age, customers expect a consistent customer experience across all channels, no matter which one they choose. In fact, 70% of customers consider a consistent customer experience across all channels to be extremely important. This will enable them to switch between channels, according to their convenience, without losing the experience. However, as per the State of CX in India report, 47% of organizations lack access to deep customer data and identify it as one of the biggest obstacles in achieving CX success.

Develop a Loan Lending app with a centralized system that integrates all your customers’ data. This includes customer interaction, from loan applications to credit scores and spending habits. Make this data accessible across all channels, including digital, offline, kiosks, call centers, etc.

For example, suppose a customer starts a loan application online and later decides to complete it in the bank itself. In that case, your representative should have the information to pick up right where the customer left.

An omnichannel approach also involves customer support and gathering customer feedback across multiple channels. Make sure that you provide different options for your customers to reach out to you regarding their issues and are provided with the same experience across all channels.

→ Read More: See how a true AI feedback platform for banks, insurance, and NBFCs helps you deliver a seamless omnichannel experience.

Boost your customer experience with SurveySensum by establishing omnichannel communication with your customers, creating a hyper-personalized experience, omnichannel customer data integration, and being proactive!

5. Modernize Your Contact Centers

Being reactive isn’t going to cut it anymore for banking and financial organizations – they need to move from a reactive to a more proactive stage. And of the important aspects of any customer journey is customer support and resolving issues as they come will not suffice anymore, it needs to anticipate and resolve issues before they arise.

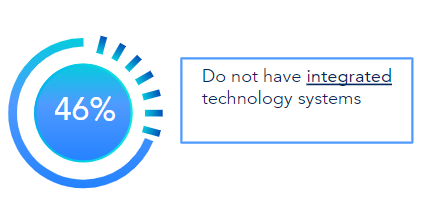

However, the biggest challenge here is that organizations lack the much-needed technical infrastructure for data integration across all channels. In fact, 46% of organizations don’t have the right integrated technology systems which is why they are unable to prioritize action and proactively close the loop with dissatisfied customers.

That’s exactly why banks need to integrate technical advancements like AI, machine learning, automation technologies, etc into their system to not just resolve issues as they come but also to anticipate them before they even arise. Banks also need to invest in agile support software and CRM tools that offer better customer data visibility, making it easy for cross-team collaboration. Advanced banking IT solutions can further enhance these efforts by integrating data and providing seamless collaboration across departments, enabling faster resolution of customer issues and improved service delivery.

Along with that, banks also need to provide customers with self-service options like FAQs, AI-assisted chatbots, IVR systems, etc, so that they can resolve minor issues or even troubleshoot problems on their own, reducing long wait times.

6. Close the Loop on Measurement

In order to improve customer experience you need to measure current state of customer experience because you can’t manage and improve something that you don’t measure. However, relying only on surveys is not sufficient. In order to measure well, you need to follow a closed-loop approach that revolves around capturing, interpreting, acting, and monitoring.

This trend involves continuously gathering customer feedback, interpreting the data to uncover actionable insights, acting on those insights, and then monitoring the outcomes to make further improvements.

Capture feedback with journey-based surveys launched across different touchpoints in a customer journey, instead of launching it randomly, and make sure you are launching the right type of survey at the right time. Then interpret your feedback accurately with the help of AI-powered analysis tools to analyze a large number of unstructured data to identify recurring customer patterns and pain points. Now, once the feedback is interpreted, the next step is to take action based on the gathered insights and to close the feedback loop with dissatisfied customers. And finally, keep monitoring the implemented changes to measure the effectiveness of your action.

For example, banks can use customer feedback to identify areas of frustration—such as long wait times or confusing online processes—and quickly implement changes to address these issues. This continuous feedback loop ensures that banks remain agile and responsive to customer needs, ultimately driving growth and loyalty.

Conclusion

Customer experience in banking is undergoing a significant transformation, driven by the rapid migration to digital channels, the rise of AI-driven personalization, and the growing importance of conversational experiences. As banks modernize their contact centers and close the loop on customer feedback, they are better equipped to meet evolving customer expectations and foster loyalty. The success of these trends lies in the ability to deliver seamless, personalized, and responsive experiences, ensuring that banks remain competitive in a landscape where CX is now the defining factor of long-term success.