How successful is your NPS B2B Program?

Did you encounter any challenges while implementing it?

Well, I’ve seen many brands face several challenges while implementing it. For instance, ‘what objective to choose?’, ‘the right questions to ask’, ‘when to send the survey’ or ‘whom to send the survey’, and many more.

Not just that, effectively analyzing survey results for maximum benefits can also pose a challenge.

Also, while NPS is very common in B2B (and brands majorly focus on that), it’s essential to acknowledge that CSAT surveys can play a critical role at certain touchpoints, providing relevant insights to enhance your understanding of customer sentiment.

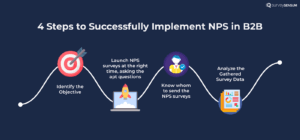

To tackle these issues and make the most of NPS implementation for your business, we interacted with diverse B2B clients and devised a practical 4-step guide.

This comprehensive NPS in B2B guide will help you create appropriate NPS and CSAT questions, determine the ideal timing to send the survey, select the right recipients for the survey, and more.

Let’s get started by implementing NPS in B2B.

4 Steps to Successfully Implement Net Promoter Score B2B

Here are the 4 steps to implement NPS in B2B:

- Identify the objective

- Launch NPS surveys at the right touchpoint, asking the right questions

- Know whom to send the NPS surveys

- Analyze the gathered survey data

So, let’s start with the first step.

STEP 1: Identify the OBJECTIVE of Your NPS Program

Knowing the objective is really crucial when it comes to implementing NPS surveys in B2B. It helps you to focus your efforts, gather relevant feedback, and gain valuable insights into customer satisfaction and loyalty.

So, how can you do this? – Identify the pain points that you’re facing.

Here are the 4 common challenges that B2B companies face:

#Challenge 1: Understanding Customer’s Perception of Your Brand

To understand your customer’s perception, you need to

- Design a clear and concise NPS survey to collect feedback.

- Target key decision-makers and stakeholders in your B2B customer base.

- Analyze quantitative and qualitative feedback to identify areas of improvement and improve customers’ experiences.

- Gain deeper insights by including follow-up questions and then schedule a live session with customers.

- Use competitor analysis to benchmark your brand perception.

#Challenge 2: Preventing Customer Churn and Contract Non-Renewals

Companies lose $1.6 trillion per year due to customer churn! And according to Forrester, it costs 5 TIMES MORE to acquire new customers than it does to keep an existing one.

This statistic shows how losing customers in B2B can have a big impact on your business’s success. Not only does it impact revenue, but it also affects your brand reputation and market position. So, to prevent customer churn and contract non-renewals, you must:

- Monitor NPS trends with efficient NPS software tools.

- Reach out to detractors to understand and resolve their issues.

- Implement customer success initiatives to improve overall satisfaction.

- Implement NPS in customer service for heightened CX.

- Use the gathered feedback to enhance product/service offerings based on customer needs, and

- Implement customer retention strategies, such as personalized discounts, loyalty programs, or proactive customer success initiatives.

#Challenge 3: The Challenge to Upsell and Cross-Sell to Your Current Customers

To resolve this pain point, you must:

- Identify promoters who are more likely to become brand advocates. Engage them in referral programs or case studies to attract new customers.

- Analyze feedback from passives to identify opportunities for upselling.

- Customize upsell/cross-sell offers based on individual customer feedback.

#Challenge 4: How to Leverage Promoters for Referrals and WoM?

You can leverage promoters for referrals and word-of-mouth (WoM) in B2B by the following:

- Request referrals from PROMOTERS- your satisfied customers.

- Incentivize referrals through rewards or exclusive offers.

- Encourage promoters to share their positive experiences on social media or review sites.

- Track and analyze the effectiveness of referral campaigns. Monitor the number of referrals generated, and measure the impact on lead generation and conversion rates.

Once you identify your business pain point then accordingly you can launch NPS surveys.

STEP 2: Launch Surveys at the Right Touchpoint & Ask the Right B2B NPS Questions

Now that the objective is clear, you need to determine when to launch these surveys because timing is crucial.

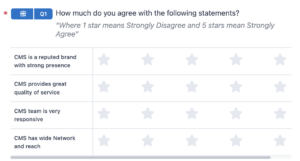

Here’s an example of CMS, a leading B2B service company, implementing NPS for the first time. Their objective was to understand how their clients truly felt about their services. After conducting this NPS survey, they identified both detractors and promoters among their customers.

Similarly, here are the touchpoints of other B2B industries on which you can launch NPS surveys and ask the right questions.

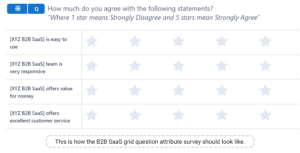

1. B2B SaaS

In B2B SaaS, there are multiple touchpoints on which you can send NPS surveys, but sending the surveys is not sufficient. You must ask the right questions to gather hidden insights that will help you to improve customer satisfaction.

Semesterly – decision maker To measure relationship and overall customer satisfaction quarterly and semesterly from the user or decision-maker.

| B2B SaaS | When to Conduct the Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| Onboarding | 2 weeks after sign-up | Onboarding Experience Survey | CES or CSAT | New customers | To measure the effectiveness of onboarding |

| Customer Support | After resolving an issue | Customer Support Satisfaction Survey | CSAT | Customers who received support | To assess customer satisfaction with support |

| New feature launch | One Week after release | Product Feedback Survey | CSAT and CES | Product users | To gather insights for product improvement |

| Product Usage and Overall Relationship | Quarterly or semesterly (every 6 months) | Relationship NPS | rNPS | Quarterly – product user

Semesterly – decision maker |

To measure relationship and overall customer satisfaction quarterly and semesterly from the user or decision-maker |

Discover how you can launch a product feedback survey in under 5 minutes SurveySensum and gather actionable insights to improve your B2B SaaS product. Book a free demo right now!

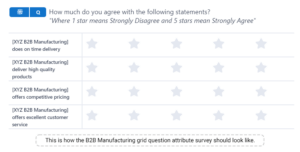

2. B2B Manufacturing

In B2B Manufacturing, companies launching NPS surveys at specific touchpoints can provide valuable insights into customer satisfaction and loyalty. With that, you can also identify areas for improvement, and foster long-term relationships with your clients.

| B2B Manufacturing | When to Conduct the Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| Order Delivery | Upon product delivery or after product delivery | Delivery Satisfaction Survey | CSAT | Customers who received orders | To measure satisfaction and identify areas for improvement |

| Post-Purchase | 6- Monthly after purchase | Product Feedback | CSAT | Existing customers | To gather insights for product improvement and usage patterns |

| Customer Support | After resolving an issue | Customer Support Satisfaction Survey | CSAT | Customers who received support | To measure satisfaction with support and identify areas to improve |

| Overall Relationship | Every 6 months | Relationship NPS | rNPS | Decision Makers | To build a relationship and measure their overall satisfaction level |

While creating surveys, you can ask the following questions NPS question for B2B Manufacturing:

- On an 11-point scale, how likely are you to recommend our company for the overall partnership we provide?

- Based on your experience, how likely are you to recommend our company for the effectiveness of our implementation process?

In the B2B Manufacturing NPS Question, the common key attributes can be:

- Overall Partnership

- Implementation Process

- Customer Support Interactions

3. B2B Marketing & Advertising

In the realm of B2B marketing and advertising, NPS surveys shine as illuminating gems. How?

Imagine you are running a B2B Marketing agency. You’ve completed a contract and now you send a relationship NPS survey to know your client’s experience. Positive responses highlight campaign successes, while any negative feedback guides you to improve and refine your marketing strategies. With this feedback, you also get to know about renewing their contract.

This is how NPS surveys became your compass, guiding you to forge stronger bonds, exceed expectations, and unveil the pinnacle of success.

| B2B Marketing & Advertising | When to Conduct the Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| NPS After Project Ends | After the contract ends (3 or 6 months) | Project NPS | NPS | Project participants | To measure overall customer satisfaction quarterly and semesterly |

| Relationship NPS after long project ends (1-2 years) | Every 6 months | Relationship NPS | rNPS | Contract participants | To build relationships and gauge the satisfaction level |

The right NPS questions that you can ask are:

- On a scale of 0-10, how likely are you to recommend our company based on the effectiveness of our recent marketing campaign?

- Considering the impact of our advertising efforts, how likely are you to recommend our company for the messaging used?

In B2B Marketing & Advertising, some relevant attributes to ask in the NPS questions are

- Campaign’s Effectiveness

- Messaging Quality

- Creative Elements

- Overall Client Experience

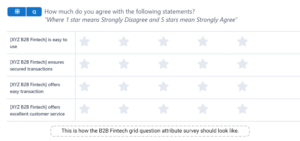

4. B2B Fintech

For NPS in Fintech B2B, companies launching customer feedback surveys at the right touchpoint can help them understand their customer sentiment, make data-driven decisions, and continuously evolve to meet client needs, ultimately driving success and profitability.

For NPS in Fintech B2B, companies launching customer feedback surveys at the right touchpoint can help them understand their customer sentiment, make data-driven decisions, and continuously evolve to meet client needs, ultimately driving success and profitability.

| B2B Fintech Touchpoints | When to conduct the Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| Onboarding | After sign-up or integration | Onboarding Experience Survey | CSAT | New customers or integrated clients | To assess the effectiveness of onboarding and integration |

| Product Usage | Ongoing basis or periodically | Product Satisfaction Survey | CSAT | Product Users | To measure satisfaction with your fintech product. |

| Overall Relationship | Every 6 months | Relationship NPS | rNPS | Users and Decision Makers | To build and measure overall relationships, customer satisfaction, and track changes over time. |

| Customer Support | After resolving an issue | Customer Support Satisfaction Survey | CSAT | Customers who received support | To measure satisfaction with support and identify areas to improve |

You can ask the following NPS questions:

- On a scale of 0-10, how likely are you to recommend our fintech platform for its user-friendly onboarding experience?

- Based on your experience, how likely would you recommend our customer support team for their assistance?

In the B2B fintech NPS Question, some common attributes are

- Implementation Process

- Account Managers’ Responsiveness

- Product Bugs

- UI

- Overall Product Value

Struggling to write the perfect survey? Discover how SurveySensum’s AI-powered survey builder analyzes your goals, suggests relevant questions, and ensures a seamless survey experience – so you get accurate, actionable feedback every time!

5. B2B Service

CMS, a B2B service, recognizes the significance of mapping customer journeys with SurveySensum. By launching targeted surveys at key touchpoints, they collect valuable feedback. This data is then analyzed and utilized to continuously enhance their B2B service offerings.

| B2B Service | When to Conduct NPS Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| Service Delivery | After project completion | Service Satisfaction Survey | CSAT | Clients who received service | Measure customer satisfaction with the service delivered |

| Customer Support | After resolving an issue | Customer Support Satisfaction Survey | CSAT | Clients who received support | Measure satisfaction with support and identify areas to improve |

| Overall Relationship | After 3 or 6 months | Relationship NPS | rNPS | Decision Makers | To build and assess customer relationship with their satisfaction level |

Following are the survey question examples:

- How satisfied are you with the overall quality of the service provided?

- How likely are you to recommend our CMS services to your friends and colleagues based on your experience?

In the B2B Service, NPS Question, the common key attributes can be:

- Product or Service Quality

- Reliability

- Customer Support

- Communication

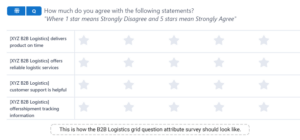

6. B2B Logistics

In the B2B logistics industry, optimizing the customer journey can position themselves as trusted partners in their client’s supply chain and logistics operations. This enriches their shipping experience.

| B2B Logistics Touchpoints | When to conduct the Survey? | Which Survey to Launch? | Question Type | Whom to Send the Survey? | Why Launch a Survey? |

| Delivery Experience | After order delivery | Delivery Satisfaction Survey | CSAT | Customers who received orders | To measure customer satisfaction with the delivery experience |

| Customer Support | After resolving an issue | Customer Support Satisfaction Survey | CSAT | Customers who received support | To measure satisfaction with support and identify areas to improve |

| Overall Relationship | Periodically during the account management phase or upon request | Account Relationship Survey | Relationship NPS | Key account Decision Makers | To evaluate the strength of the business relationship and assess the overall customer satisfaction and loyalty |

Some examples of NPS scale questions are:

- On a scale of 0-10, how likely are you to recommend our logistics services based on the timeliness of our order fulfillment?

- Considering our overall partnership, how likely are you to recommend us for the reliability of our logistics solutions?

In the B2B logistics NPS Question, the common key attributes can be:

- Order Fulfillment

- Reliability

- Communication

- Partnership Satisfaction, and Experience

These attributes capture the quality of delivery services, responsiveness of the logistics provider, and the overall experience of working together.

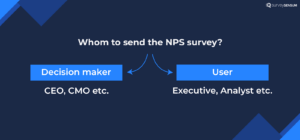

STEP 3: Who to Send the Survey to While Implementing Net Promoter Score B2B?

Your NPS survey is ready to launch but to whom you’re going to send surveys?

You can send surveys to either the DECISION MAKER or USER of the product.

1. Product Users:

Send surveys to the product users since they are the ones who are regularly using the product. They can help you improve your product and share insightful recommendations for the product roadmap. They are the influencers behind choosing your brand.

2. Decision Makers:

Send surveys to the decision makers since they are the ones responsible for making critical decisions about whether to renew the product, continue with your services, or explore alternative options. Building a healthy relationship with them is essential to understand their needs and preferences better.

But wait – Which accounts to prioritize?

- Segregate your survey sample into Small Accounts, Key Accounts (KA), and Premium. This allows you to analyze NPS results specifically for each account type, providing insights into different customer groups.

- Identify Decision-Makers who have the authority to influence purchasing decisions or provide valuable feedback.

- Target the right job function to ensure that you reach the individuals most involved in the decision-making process or directly interact with your products or services.

Step 4: How to Analyze the Received Data?

Here’s how CMS analyzes the received data and takes action on it.

CMS took a proactive approach. Their CMO personally visited detractors, engaging in physical meetings to understand their concerns and improve the overall customer experience. This unexpected level of attention delighted unhappy customers, resulting in an improved NPS score and an influx of positive feedback.

The idea behind the meeting with the promoters was to gain insights into their positive experiences and identify the strengths of the company. This dedicated effort to gather and analyze feedback allowed CMS to improve customer retention and pave the way for business growth and success.

So, to analyze the gathered data you have to:

- Segment the data by account type

- Analyze feedback for each product or service offered to identify strengths and areas for improvement.

- Collect feedback from different user roles to gain a comprehensive understanding of user experiences.

- Calculate NPS scores across different account segments and by product or service.

This is how you can analyze the feedback and improve your NPS score.

Companies with high NPS scores tend to experience faster revenue growth compared to their competitors. A leading example is Amazon Prime. CIRP research has shown that 73% of people who try out Amazon Prime become paid members. And after the first year, 91% of the members renew their subscription for a second year, and 96% of those members pay for a third year as well.

Struggling to make sense of survey data? Discover how SurveySensum’s analytics automatically categorizes responses, detects sentiment, and uncovers hidden insights – all in real time!

So, with these 4 steps, you can implement a B2B net promoter score effectively. However, what matters the most is implementing these steps to monetize NPS, so let’s discuss that.

The Monetized Net Promoter System for B2B

The monetized NPS approach goes beyond traditional NPS metrics which only focus on customer loyalty and satisfaction by incorporating financial factors such as revenue, customer retention, and the influence of customer advocacy. This approach effectively integrates customer feedback into a strategy for business growth.

So, how do we implement this system?

1. Measure

The first step in monetizing NPS involves gathering customer feedback through well-designed surveys. For B2B companies, the method and frequency of surveys play a crucial role in ensuring accurate and actionable insights. So,

- Focus on gathering regular feedback to ensure that you track sentiment changes over time and boost retention rates.

- Send NPS email surveys to business addresses as it offers convenience and scalability for B2B accounts.

- Limit the survey to 2–6 questions to balance depth and response rates.

- Engage more contacts within each account as it doesn’t just improve response rates but also strengthens customer retention.

2. Act

The second step focuses on taking action based on the feedback collected, a process known as “closing the loop.” This involves following up with customers to inform them about the actions you’ve taken based on their feedback. Closing the loop demonstrates that customer input is valued and acted upon and it also improves response rates, reduces churn, and enhances customer loyalty.

3. Monetize and Grow

The final step is about tying customer feedback to business growth by understanding the financial implications of NPS insights.

- Prioritization Based on Value: Identifying high-value accounts helps allocate resources to where they’ll have the most impact.

- Churn Risk Assessment: Monetization provides visibility into which accounts are at risk of churning and the potential revenue loss.

- Proving ROI: Quantifying the financial impact of CX efforts helps validate the importance of NPS and secures buy-in for customer experience programs.

- Leveraging Promoters: Promoters are your most loyal customers and are often willing to upsell or refer to new businesses. Since 80% of profits typically come from 20% of customers, focusing on promoters is a powerful growth strategy.

But only implementing NPS is not enough because NPS is not just about the score, it’s what you do with it that matters the most. This is why after implementing NPS in B2B, you also need to take action on the feedback by closing the feedback loop in B2B. Let’s see how to do that.

Closing the Loop on Passives and Detractors in Net Promoter Score B2B

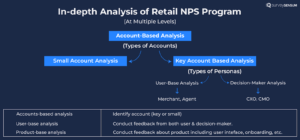

To effectively close the feedback loop in B2B and drive meaningful improvements, a comprehensive account-based analysis is crucial. There are two primary types of accounts: Small accounts catering to small businesses and key accounts serving larger enterprises.

Here we’ll focus on the key account-based analysis since it involves gathering feedback from a significant number of customers.

Key Account-Based Analysis: Within the key accounts, you will encounter two distinct personas: Users and decision-makers.

User-Based Analysis:

- Begin by identifying user segments, such as merchants, agents, etc., and conduct NPS surveys to gather feedback directly from them.

- Analyze the responses in detail to gain valuable insights into their specific needs and challenges.

- Prioritize the identified areas for improvement, and effectively communicate the action plans taken to enhance their satisfaction.

Decision-Maker Analysis:

- Identify the key decision-makers within the key accounts, including CEOs, CXOs, etc., and gather their feedback.

- Thoroughly assess their concerns and expectations to develop tailored solutions that address their unique requirements.

- Engage in personalized follow-ups and establish a sense of trust and collaboration with these decision-makers.

Small Account-Based Analysis: Small accounts cater to small businesses, and their feedback can provide valuable insights into their specific needs and challenges. Although there may be a larger number of small accounts, their individual feedback can collectively guide improvements to enhance overall customer satisfaction.

- Segmenting Small Accounts: Just like with key accounts, it’s essential to segment small accounts based on factors such as industry, location, or the type of service they use. This segmentation can help target the right questions and gather feedback relevant to each segment’s requirements.

- NPS and Customer Feedback: Utilize Net Promoter Score surveys or other customer feedback methods to gather insights from small account holders. Understanding their level of satisfaction and loyalty helps identify areas for improvement.

- Personalized Approach: Small businesses often appreciate a more personal touch. Engage with them on a one-on-one basis if possible, acknowledging their feedback and addressing their concerns directly.

Get instant alerts for detractors, assign cases to the right team, and track resolution progress with SurveySensum—all in one platform!

Tips for Closing the Loop Successfully in Net Promoter Score B2B

Tip 1: Involve the Company’s Leadership

The active participation of the company’s CEO or CXO is instrumental in demonstrating the organization’s commitment to customer feedback. Their involvement encourages all teams to take necessary actions. If direct participation is challenging, leverage customer feedback reports to illustrate the importance and impact of customer insights. Sharing NPS reports and survey insights can foster engagement and alignment across the organization.

Tip 2: Leverage Promoters and Positive Feedback

Harness the power of promoters – satisfied customers who provide positive reviews and testimonials. Share these positive experiences with your internal teams to inspire them and instill a customer-centric mindset. Cultivate a culture of continuous improvement by showcasing how customer satisfaction is driving success.

By incorporating these Net Promoter Score strategies into your feedback loop process, you can create a customer-centric approach that drives continuous improvement and fosters long-term success for your business.

But what happens when you send the survey and don’t get enough response rates to make the NPS analysis?

Tips to Follow to Increase Response Rate in Net Promoter Score B2B

You’ve launched your NPS surveys successfully but do you know the best Net Promoter Score strategies that you can use to boost your NPS survey response rate?

Here you go –

- Regularly conduct B2B customer feedback surveys to gain valuable customer insights.

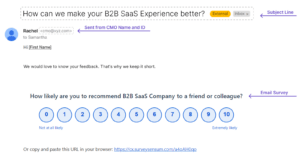

- While creating surveys, you must select the best survey design and template as per your brand.

- Write a clear subject line that conveys your message and the purpose of conducting surveys.

- Always create short surveys. For relationship NPS -5 to 7 questions are ideal and for transactional NPS (tNPS) – 2 to 3 questions are ideal.

- Ensure sending NPS surveys through your business email ID like president@company.com, CMO@company.com, etc.

- Create a unique survey link per customer because everyone loves personalization.

- Don’t forget to send friendly reminders to those who’ve partially and not filled out the survey.

- Assure your customers that you’ve heard them and you’ll consider their feedback while making business decisions.

- Make sure your survey software offers you real-time reports of the survey sent rate, bounce rate, and response rate.

- Set the KPI for account managers to boost the response rate because customers won’t respond if you don’t push them. That’s why target at least a 50-60% response rate.

- If you’re unable to send all the emails then you need to whitelist your email domain.

Say goodbye to time-consuming survey creation! Discover how you can create intelligent, well-structured surveys in just a few clicks with SurveySensum – no expertise required!

Now, the NPS program in B2B is implemented successfully, but one question still remains – does NPS really work for B2B?

Does NPS Work for B2B?

Yes, it does. But it does work a little differently than in a B2C context. In B2B, since the ticket size is larger compared to B2C, earning the loyalty of even one customer is a win because in B2B each customer is worth so much more than in B2C. This enables companies to save large accounts from possible churning.

And while B2B relationships have some nuances compared to B2C interactions, NPS can still provide valuable insights into customer sentiment and loyalty.

Here’s why NPS works for B2B.

1. It is Simple, Universal, and Easy To Track

NPS is a simple and easy-to-understand metric that can be applied across industries, including B2B. Its simplicity makes it accessible to stakeholders at all levels of the organization, allowing for quick and effective communication of customer feedback and performance metrics. Additionally, due its simplicity and straightforwardness, this metric can be easily measured and tracked over time.

2. It Provides Actionable Insights

Since B2B has a higher churn rate, you need your survey responses to be easy to understand and act on. This is where NPS comes in. These surveys are straightforward, asking customers to rate on a scale how likely they are to recommend the company’s product or service to others.

This simplicity makes it easy for B2B companies to gather actionable insights quickly. Moreover, the follow-up open-ended question allows customers to provide qualitative feedback, enabling companies to understand the specific areas they excel in and where improvements are needed.

3. It Gives Meaningful Feedback

In B2B, customers, who have long-term relationships with vendors, are more likely to provide thoughtful feedback that goes beyond mere satisfaction ratings. This deeper understanding of customer sentiment enables B2B companies to tailor their strategies to meet specific customer needs and preferences.

4. It Gives You Clarity of Your CX Impact on the Bottom Line

By correlating NPS scores with key business metrics such as revenue, customer lifetime value, and retention rates, B2B companies can quantify the direct impact of CX on business revenue. This clarity helps prioritize CX initiatives and allocate resources effectively to areas that yield the highest return on investment.

→ Suggested Read: Understand NPS Impact on Revenue and ROI.

5. Higher Response Rate

While it is true that B2B companies have a comparatively smaller customer base than B2C companies, there’s an advantage to that.

Now, B2C relationships are quick and transaction-based, whereas in B2B relationships there’s a more personal and direct connection between the business and its clients. Also, these relationships are not impulsive, they are strategic decisions and are nurtured over time.

And as a result of this, there is a greater willingness among your clients to provide feedback, participate in surveys in greater numbers, and provide correct and relevant information, especially if they perceive the company as a valued partner. This results in a higher NPS response rate for B2B companies.

6. Closing the Feedback Loop is Easier

With B2C companies, you get a customer base of tens and thousands which makes it difficult to sort and segment through the feedback. On the other hand, having a smaller customer base makes it easier for B2B companies to quickly sort through feedback, analyze it, and take action on the feedback in real time.

In B2B relationships, communication channels between businesses are typically more direct and personalized. B2B companies often have dedicated account managers or customer success teams tasked with managing client relationships.

This direct line of communication enables swift responses to customer feedback, personalized interactions, and efficient follow-up on any concerns raised. As a result, the process of closing the feedback loop becomes more streamlined and effective in B2B settings.

7. Predictive Growth and Retention

What makes NPS effective for B2B companies?

With NPS, instead of only responding to feedback and resolving issues, B2B companies can also use the data to identify potential churn and evaluate their performance against the industry average.

By analyzing recurring themes and sentiments expressed by clients, businesses can anticipate evolving needs and proactively tailor their products or services to meet those demands. This predictive analysis enables B2B companies to stay ahead of the curve, continuously improving their offerings to align with customer expectations and maintain a competitive edge in the market.

Let’s now understand how NPS operates differently in B2B.

How Is Net Promoter Score Different In B2B?

While the fundamental concept of NPS remains the same in both B2B and B2C contexts, the application and interpretation of NPS varies due to the unique characteristics of B2B relationships. It varies vastly with the industries – from banking to e-commerce to travel.

Let’s understand these differences.

| B2B | B2C | |

| Customer Loyalty | Involve higher stakes and longer-term commitments | Short-term commitments |

| Revenue Stream | Different customer segments have different types of payment plans and one segment can be worth more than the other one | Customer segments are fairly broad and with standard payment plans |

| Complexity of Relationships | More complex and multifaceted involving longer sales cycles, multiple decision-makers, and ongoing contracts | Simpler and more transactional |

| Duration | Generally long-term and may span over many years | Generally shorter and more transactional |

| Ticket Size | Larger ticket sizes due to the larger scale of purchases | Smaller ticket sizes, reflecting individual consumer spending patterns |

So, the differences are well laid out, let’s now understand how to implement NPS in B2B.

Now, before we wrap things let’s talk about a few important topics like must-dos to improve NPS.

Must-Dos for a B2B Company to Improve NPS

Here are some important points to keep in mind if you want to improve your NPS.

- Prioritize Customer Feedback: Collect customer feedback through surveys, interviews, or focus groups. Use tools like NPS surveys to gauge loyalty and identify pain points.

- Act on Feedback: Close the feedback loop promptly. Address issues raised by detractors and show appreciation to promoters.

- Enhance Customer Support: Offer quick and personalized support. Ensure your customer success team has the tools and training to resolve issues effectively.

- Deliver Consistent Value: Ensure your product or service consistently meets or exceeds customer expectations. Regularly update offerings based on customer needs.

- Foster Strong Relationships: Build trust through regular communication, transparent processes, and positioning your brand as a partner in their success.

- Leverage Promoters: Encourage satisfied customers to leave testimonials, participate in case studies, or refer others.

- Monitor NPS Trends: Track your NPS regularly to identify patterns, assess the impact of changes, and set realistic improvement goals.

Conclusion

So, to answer your question – yes, NPS does work for B2B. While traditionally associated with consumer-facing businesses, NPS can be adapted and implemented in a B2B context to gather valuable insights into the dynamics of long-term partnerships, and personalized interactions. By leveraging NPS data, B2B companies can gauge client sentiment, identify areas for improvement, and strengthen relationships through targeted action and strategic decision-making.

Now, to make sure you implement NPS in B2B correctly, make sure to follow the four steps mentioned in the blog, along with robust NPS software like SurveySensum. With this tool, you can launch, measure, analyze, and create an action plan – all in one place, by leveraging the tool’s advanced AI-enabled features and CX consultation from top CX experts.

Refine your CX Strategies to Elevate B2B Client Relationships With SurveySensum!

FAQs

A good NPS score in B2B can vary depending on industry standards and benchmarks. Generally, a positive NPS score (above 0) is considered favorable, indicating that there are more promoters than detractors. However, the specific interpretation of a “good” score may differ between companies and industries. Some businesses aim for scores in the range of 50-70 or higher, while others may consider improvements necessary even with positive scores.

2. Can NPS be used for B2B?

Yes, NPS can be effectively used for B2B purposes. While it’s commonly associated with consumer-facing businesses, NPS is equally applicable in B2B environments for measuring customer satisfaction, loyalty, and advocacy.

The Net Promoter Score question typically asks: “On a scale of 0 to 10, how likely are you to recommend [Company/Product/Service] to a colleague or friend?”

The response rate of B2B NPS surveys can vary depending on factors such as the industry, the relationship between the business and its clients, the method of survey distribution, and the incentives offered for participation. Generally, B2B surveys tend to have higher response rates compared to B2C surveys due to factors such as personal relationships, professional engagement, and the value of insights exchanged.

NPS in the B2B industry is widely used to measure customer loyalty and gauge overall satisfaction. Here’s how it is implemented:

- NPS surveys are used to collect feedback after key milestones, such as contract renewals, project completions, or major product updates.

- B2B companies use NPS to evaluate account health and identify at-risk customers who might churn.

- Feedback from NPS helps refine products, services, and customer interactions to better align with client needs.

- NPS allows businesses to compare loyalty across different segments, such as industry types, geographies, or account sizes.

- By addressing detractor feedback promptly, companies can reduce churn.

- Promoters are more likely to renew contracts, purchase additional services, and refer others, driving growth.

- NPS feedback provides actionable insights that help tailor strategies to customer needs.

- A high NPS indicates strong customer loyalty, enhancing the company’s reputation in the market.

- NPS enables B2B companies to track performance over time and benchmark against competitors.

- Use the customer’s name and mention specific projects or interactions to make the survey feel relevant.

- Send surveys after meaningful touchpoints, such as after a successful project delivery or a quarterly review meeting.

- Ensure the survey is concise and easy to complete, usually with one main question and an optional NPS follow-up question.

- Consider non-monetary incentives, such as exclusive insights or early access to features, to encourage participation.

- Send reminders to customers who haven’t responded yet, but ensure they’re spaced out to avoid being intrusive.