Customer loyalty and satisfaction are crucial when it comes to banks. More than often, customers are attracted to banks that value them and offer good service.

But when every bank strives to achieve the same, how can you get a competitive edge?

This is where Net Promoter Score comes into play. This CX metric has the ability to gauge customer loyalty and predict business growth.

Using NPS in finance industry can get to the heart of why customers would or wouldn’t recommend them to others. The answers to these questions can point out where banks need to improve, what new things they can try out, and how to boost customer satisfaction and loyalty.

In this guide, we’re going to take a deep dive into why NPS in banking industry is so important, how to work it out, how to use it to get better, and more.

Let’s start with the simplest one.

What is NPS in Banking and Other Financial Institutions?

In banking, it is crucial to gauge customer satisfaction and loyalty.

Why?

Because of the higher competition and commoditization of banking products and services. And this is where NPS comes into play.

NPS metric is used to gauge a business’s customer satisfaction and loyalty. It asks the customers how likely they are to recommend the company’s products or services to others, typically on a 5 or 11-pointer scale. And an NPS score can be from -100 to 100 and can provide insights into a bank’s overall customer experience.

A high NPS score in banking indicates a stronger customer relationship, more referrals, and, therefore, greater growth.

Now, let’s move on to the next part, where we’ll discuss why having loyal customers is such a big deal for banks and other financial services.

The Impact of Loyal Customers on a Bank’s Bottom Line

NPS methodology is about understanding your customer loyalty and satisfaction and taking measures to improve them. Check out the following points to get a better idea of why customer loyalty is essential for banks and other financial services.

1. Increased Profitability

Loyal customers tend to use more banking services, leading to higher profitability. Also, they are more likely to opt for additional services or products, such as credit cards, business credit cards, or loans, from the bank

2. Reduced Acquisition Costs

It costs 6x to 7x more to acquire new customers than to retain an existing one. Loyal customers tend to stay with the bank longer, reducing acquisition costs and saving money.

3. Referrals

Loyal customers, and promoters, are more likely to recommend the bank to their peers or friends. Therefore, this is a cost-effective strategy to acquire new customers.

4. Feedback and Improvement

Loyal customers tend to provide more actionable feedback. Therefore, banks can leverage it to refine and improve their services. Acting on the feedback and improving the services show how much you value the customers, further increasing loyalty.

Reasons Why You Should Measure NPS in Banking and Other Financial Services

Following are some of the main reasons you should measure NPS in banking industry and other financial services.

By analyzing the feedback, banks can pinpoint the areas that need improvements.

1. NPS can serve as a leading indicator of growth or contraction, giving a clear idea about promoters and detractors.

2. NPS allows you to benchmark the bank’s performance with competitors across the industry.

3. Banks can improve their service by identifying and addressing the concerns of detractors and passives. This can help increase customer lifetime value and reduce customer churn.

4. Maintaining a strong reputation is key to managing risk in the financial sector. A low NPS could indicate reputational issues that need to be addressed.

5. By constantly improving the NPS score, banks can ensure strong customer loyalty, leading to customer acquisition and increased revenue.

Now that you have understood the importance of NPS surveys in banks, let’s discover the right time to launch the NPS survey in banks.

When Should You Launch Your NPS Surveys in Banks?

Choosing the right time to launch an NPS survey is essential to effectively capture insights. You might be thinking of sharing NPS surveys with customers soon after they have interactions with the bank. This type of NPS survey is called Transactional NPS.

But in reality, this is not a best practice.

Imagine yourself as a customer. Would you recommend a bank after a couple of interactions with it? Most probably not, right? Then why would others be any different?

You should launch a survey after customers interact with the bank or have made a transaction. Just not NPS but CSAT.

So, when should you launch NPS surveys?

1. Relationship NPS Surveys – The Right NPS Survey For Banks

These surveys are done on a set period, usually every 6 or 12 months. A relationship survey assesses overall customers’ satisfaction and loyalty to the bank.

Conducting these surveys too often can lead to survey fatigue. But at the same time, waiting too long might result in missing out on timely insights from customers.

2. Post-Service Resolution Surveys

If and when a customer contacts the bank regarding a problem, it’s best to follow it up with an NPS survey after the issue has been solved. This way, banks can understand the level of satisfaction the customer had with the resolution process.

3. Onboarding Survey

It is essential to get feedback from new customers. Ideally, it is best to wait a month or two before launching the survey. This way, banks can ensure that the customer has enough time to use the banking service.

The survey offers insight into the customers’ initial impressions of the bank and its services. Following is an example of an NPS survey question banks can ask after onboarding –

“After using our banking services for the past few months, on a scale from 0-10, how likely are you to recommend our bank to a friend or colleague based on your initial experience?”

Now, the key thing to keep in mind is to balance the frequency of the surveys sent out. You don’t want your customers overwhelmed or frustrated.

Also, it is essential to consider factors such as response rates, size of the customer base, and customer segments while launching the NPS survey in banks.

Measure what matters most! Gain real-time insights with SurveySensum’s NPS software to drive customer retention and loyalty!

How to Calculate NPS in Banking?

The calculation of the NPS in the banking sector is the same as in any other industry.

Start by surveying your customers with the standard NPS survey question:

“On a scale of 0-10, how likely are you to recommend our bank (or a specific banking service) to a friend or colleague?”

Based on their response, customers can be classified into three categories:

- Promoters: Customers who are extremely happy with the product/service. They are more likely to recommend the company to others and usually give a score of 9-10.

- Passives: Customers who are happy with the product/service. They usually give a score of 7-8 and may or may not recommend the company to others.

- Detractors: Customers who are extremely dissatisfied with the product/service. They give a score of 0-6 and can damage a brand’s reputation by sharing their experience.

Once you have categorized the respondents, calculate the percentage of each section.

For example, If you launched an NPS survey to 200 customers and got back the following results:

- Promoters = 70

- Passives = 70

- Detractors = 60

Then the percentage of each will be,

- Promoters = (70/200)*100 = 35%

- Passives = (70/200)*100 = 35%

- Detractors = (60/200)*100 = 30%

Therefore the NPS score will be,

Net Promoter Score = (35% – 30%) = +5

As discussed earlier, the NPS can range from -100 (if every customer is a Detractor) to +100 (if every customer is a Promoter). And generally, a negative score indicates poor performance because of more detractors.

Let’s now explore some benefits of using NPS in banking.

Benefits of Using NPS in Banking

Here are some benefits of implementing NPS banking.

1. Enhancing Customer Satisfaction

By segmenting promoters, passives, and detractors, banking institutions can identify areas where customers are experiencing issues with their products and services and drive data-driven improvements. Understanding customer satisfaction enables banks to:

- Personalize services based on individual preferences.

- Address specific pain points, such as long wait times or confusing processes.

- Develop initiatives that foster stronger relationships, ensuring customers feel valued and heard.

- By focusing on improving satisfaction, banks can build loyalty and foster positive word-of-mouth recommendations.

2. Improving Banking Services

NPS doesn’t just help improve customer satisfaction, it goes beyond measuring customer satisfaction by helping banks improve their overall services. Feedback from detractors highlights operational bottlenecks, while input from promoters reveals what the bank is doing well. These insights can lead to:

- Streamlined processes, such as faster loan approvals or simplified account opening. They may also highlight the need to add an effective loan origination system to make lending operations even smoother.

- Enhanced digital banking experiences with improved app functionality or faster transaction speeds.

- Improved staff training programs to ensure consistent and high-quality service delivery.

- Using NPS to refine services ensures banks not only meet but exceed customer expectations.

3. Competitive Benchmarking

NPS allows banks to compare their performance metrics against their competitors by measuring how likely their customers are to recommend their services. By leveraging NPS for benchmarking, banks can create strategies to differentiate themselves and gain a competitive edge.

4. Tracking Long-Term Performance

NPS isn’t just for improving customer loyalty – it is a tool for tracking long-term performance trends. Regularly measuring NPS helps banks identify patterns, such as improvements in service or declines in customer satisfaction over time. This enables banks to monitor the effectiveness of customer experience initiatives, set long-term goals aligned with customer loyalty and retention, and adapt strategies proactively based on evolving customer expectations and needs.

Explore how SurveySensum’s automated NPS surveys can save you time and reveal what truly matters to your customers!

So, What’s a Good NPS Score in Banking and Financial Services?

A good NPS score can vary depending on the industry, region, and audience.

A score above 0 is considered good, as you have more promoters than detractors. A score above 50 is considered excellent, whereas above 70 is considered top-notch. But these are all general benchmarks.

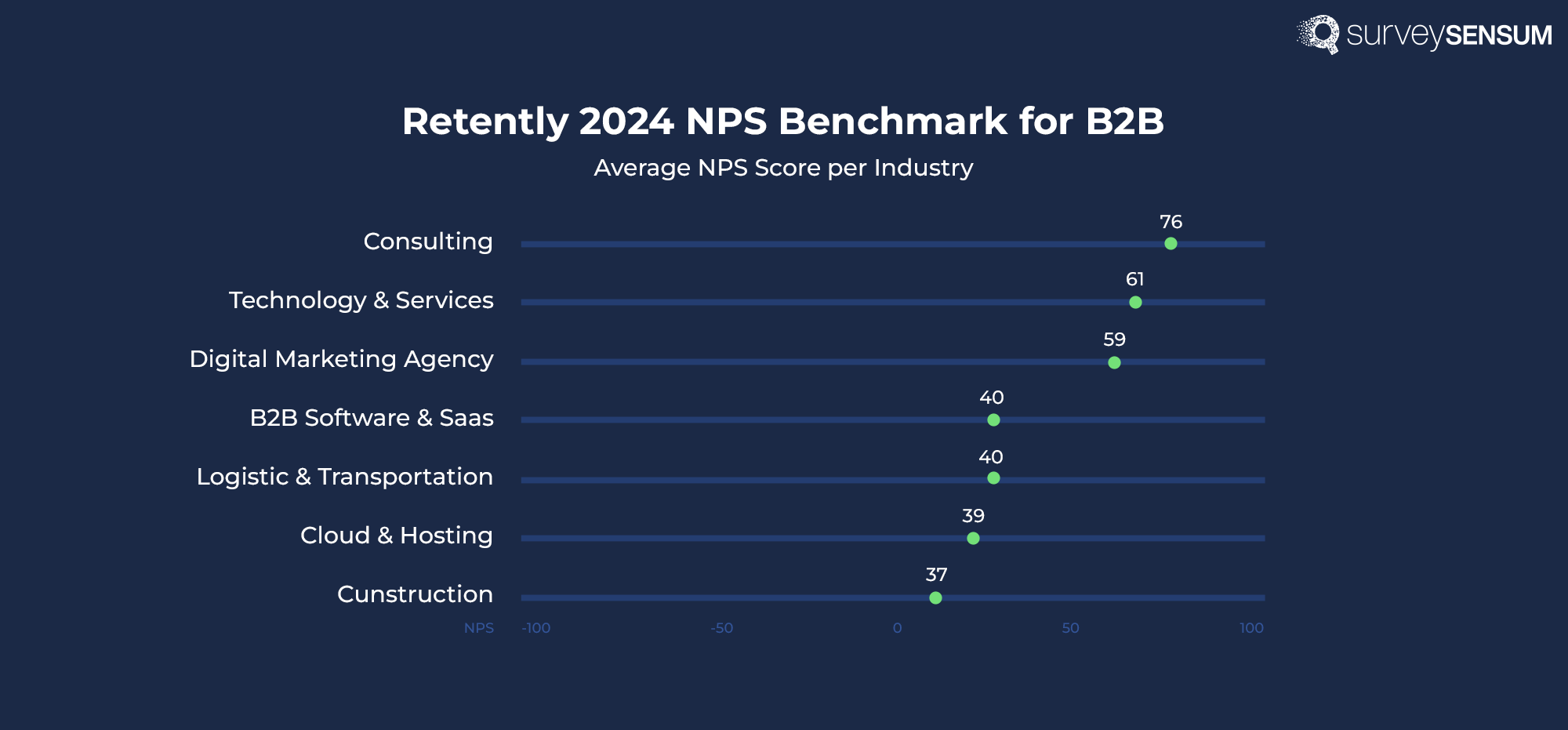

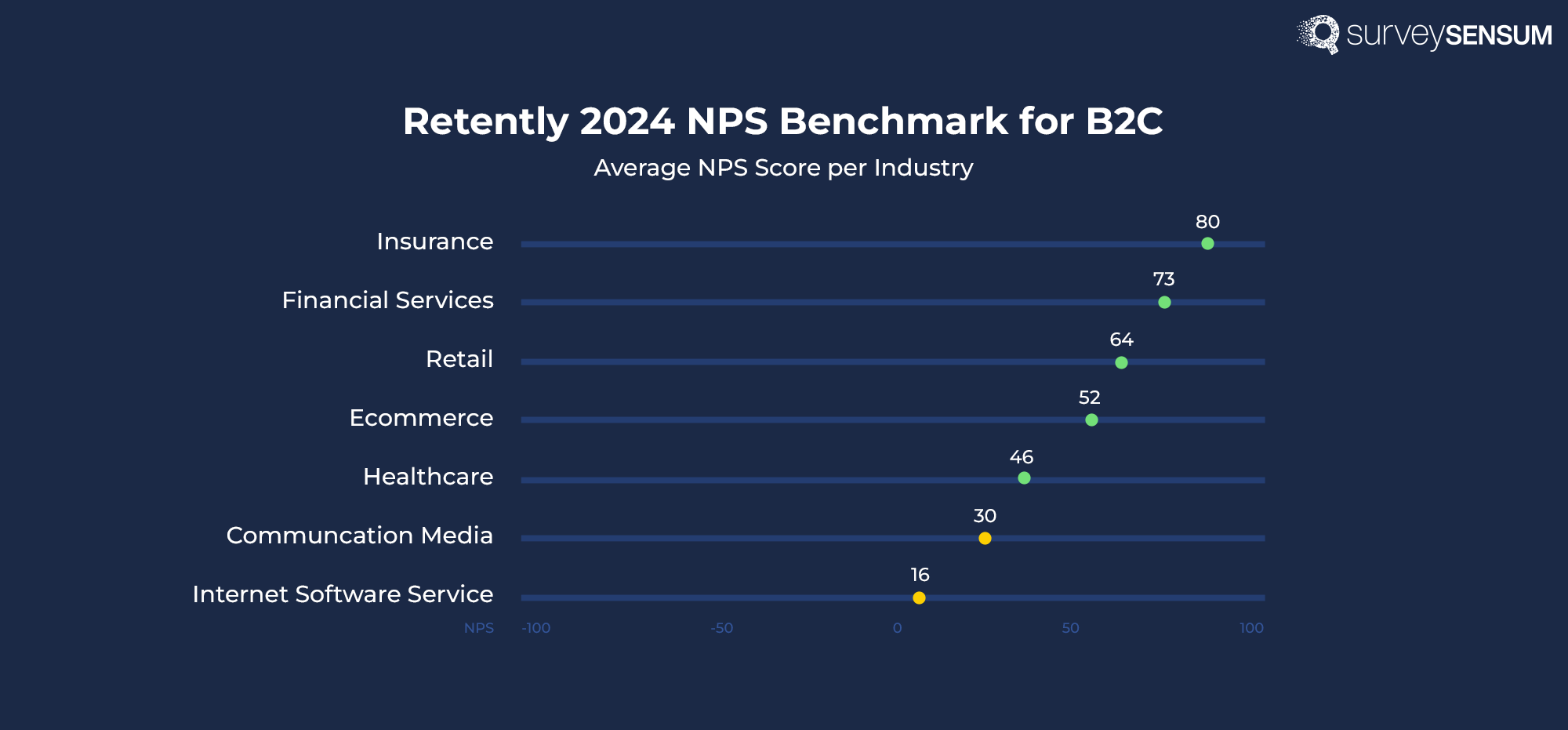

An NPS score can be considered good only if it matches or exceeds the industry average. For example, a score of 30 in B2B cannot necessarily mean a good score.

→ Suggested Read: How to Implement NPS in B2B?

According to the extensive research done by Satmetrix in 2024, the industry average NPS in financial services is 73.

*Source: Retently 2024 NPS Benchmarks for B2B & B2C

Therefore, a good NPS score in banks and other financial services will be 31 or any number above it.

What’s most crucial for a bank or financial institution is to focus on improving its NPS over time. Comparing the NPS score with the industry average or competitors will be an effective way to understand the relative position in the market.

We’ll talk more about this in the next section.

Benchmarking NPS Score in Banking and Financial Services

By benchmarking NPS, banks can understand where they stand in terms of customer loyalty and satisfaction.

Banks can compare their NPS score to understand areas that need to be improved and what their competitors are doing better. Following is a 7-step process to benchmark your NPS:

Step 1: Define your Competitors

The first and foremost process of benchmarking is defining the competitors. Several factors, like regions and target audiences, can play out here.

For instance, a credit card company might have a different NPS score compared to retail banks or wealth management firms. Similarly, neo-banks can have different NPS due to their unique service model and younger customer base.

Therefore it is vital to research and identify your competitors.

Step 2: Collect NPS Data

You need to collect your NPS data as well as your competitors. Leverage reliable NPS software to launch your survey and calculate the NPS score.

And for competitors, you can refer to public sources, industry reports, etc., for the necessary data.

Step 3: Compare the NPS Score

Once you have all the necessary data, compare them. This will give you an overall idea of where you stand in the market.

Step 4: Identify Areas for Improvement

Whether you have a higher or lower score than your competitors, always look for areas you can improve. Sometimes, even when you are performing better than the competitors, there might be a certain aspect that the competitors do well.

Step 5: Take Corrective Measures

Once you have identified the areas to improve, plan and implement proper strategies to improve them.

Step 6: Communicate the Changes

Ensure that the changes and improvements you make are communicated with the customers. This is an essential step in the benchmarking process because it provides value to them and improves their approach toward the bank.

Step 7: Repeat

Benchmarking isn’t a one-time process. Instead, leverage rNPS to periodically check the score and re-benchmark it.

Also, benchmarking your current NPS score with the previous one is also a best practice. This way you can track the progress of your efforts.

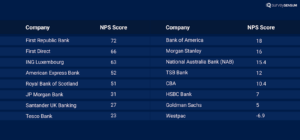

Now, take a look at some of the banks and their NPS score.

Although it is crucial to benchmark NPS in banks, the end goal shouldn’t be to get a higher score than your competitors.

The aim should be to make use of the insights gained to make meaningful improvements to enhance your customer loyalty and satisfaction.

This brings up the question of how banks can increase their NPS score.

How Can Banks Achieve High NPS Scores?

To achieve a higher NPS score for banks, it is necessary to build strong relations with customers and provide top-class experience. Take a look at some practical strategies you can employ to improve the NPS.

1. Customer Centricity:

Banks should try to create a customer-centric culture. Consider customers at the heart of all decisions, and try personalizing services to meet their needs.

2. Improve Customer Service:

Providing exceptional customer service can influence customers’ perception of a bank. Make it easy for customers to reach out with their concerns through multiple channels. Also, try to address customer concerns promptly and effectively.

3. Enhance Digital Experience:

Digital banking is becoming more prevalent. Therefore offering seamless online and mobile experiences would be another option to improve customer experience. But ensure that the bank’s digital platform is intuitive, and secure and offers all necessary services.

4. Listen and Act on Feedback:

Keep the surveys consistent and listen to customer feedback. More importantly, act on this feedback to make necessary improvements. Show customers that their opinions matter and that their feedback leads to change.

5. Build Strong Relationships:

Foster a strong customer relationship and improve customer retention through regular communication, appreciation, and recognition. Banks can achieve this by providing personalized messages, loyalty programs, and regular check-ins.

6. Regular Training for Employees:

Train the bank employees on NPS customer service skills and other services offered by the bank. Make them understand their importance in enhancing the bank’s customer experience.

Though the employees should be informed about the importance of NPS, never try to game the NPS. It could negatively impact the NPS score and provide inaccurate NPS data.

7. Quick Problem Resolution:

Problems are something no business can avoid. It will happen no matter the time or care the banks invest in avoiding it. It’s like the supervillain explained, “I am inevitable”.

What banks can do here is to resolve these issues or problems as quickly as they can. Doing so can impact the customers’ perception of the bank. Therefore, banks should implement proper strategies for swift problem detection and resolution.

Follow the above-mentioned practices to improve the NPS finance. But keep in mind that improving the NPS is a long-term strategy. Banks may have to implement changes in how they operate and interact with customers. However, the end result in terms of customer loyalty, referrals, and growth can be substantial.

Act on feedback promptly by leveraging SurveySensum’s NPS software to identify pain points and deliver exceptional customer experiences!

How to Use NPS in Banking and Financial Services?

The usage of NPS in banking and other financial services is the same as in other industries. Here are the steps to take to efficiently use NPS in banking and other financial services.

Step 1: Conduct an NPS survey and collect feedback.

Start by launching the NPS survey to gather customer feedback. You can ask survey questions like,

“On a scale of 0 -10, how likely are you to recommend us to your family and friends?”

OR

“On a scale of 0 -10, how much would you rate your mobile banking experience with us?”

Analyze the NPS data to identify the promoters and detractors from the NPS survey and calculate the NPS score. Once that’s done, follow the given steps to effectively make use of NPS in banking and financial services.

Step 2: Segmentation

The target audience of banks usually has broader characteristics. Therefore it is a good idea to segment NPS scores by different demographic groups or account types. This will provide insights into where the bank is doing well and where it needs improvement.

For example, younger customers might provide a low NPS score and suggestions to improve digital banking offerings.

Younger customers are digital natives. So, they naturally have higher expectations when it comes to digital banking offerings. And if these expectations aren’t met, it could result in lower NPS scores from this demographic.

Step 3: Benchmark the Score

Compare the different types of NPS score with the industry average and competitors. This will help you understand whether the bank is performing well or not. In addition, you can understand what the competitors are doing well and take necessary steps to negate the gap.

Also, it is good practice to compare your current NPS score with the past ones. This will help you assess whether your customer experience is improving, stagnating, or declining.

Step 4: Follow-up Questions

Even if your score is low or high, you should follow up questions with the detractors in the survey. You can identify why customers gave the score by adding relevant NPS follow-up questions. Furthermore, this helps understand the areas that need improvement.

Step 5: Close the Loop

This is one of the most crucial steps in using the NPS. Always respond to customer feedback, especially to detractors. This can help resolve specific issues and demonstrate that you value your customers.

Also, promptly dealing with issues and resolving them will provide a second chance for the banks with the unhappy customers. And in many cases, closing the feedback loop can help convert the detractors into promoters.

→ Know how to boost NPS in Automotive by closing the feedback loop!

What you should keep in mind is that NPS is a tool and not a solution in itself. It offers a way to gauge customer loyalty and satisfaction, that’s all. So it’s up to you to make use of the information you gained from NPS to improve the bank service and the overall customer experience.

Now that’s covered, let’s look at some trends in banks and other financial services.

Key Trends in Banking and Financial Institutions

There are several trends in banking and financial services that can affect or influence the NPS. Following are some of the key trends you should be aware of.

1. Digital Transformation:

Unlike in the old times, customers will not frequently visit physical offices. Therefore, banks need to be where their customers are: the digital world.

Digital platforms offer easy accessibility to banking services and when done right, greater efficiency as well. This can influence a customer’s experience and, therefore, the NPS.

However, ensure that the digital experience is seamless and devoid of any issues. Any issues or difficulties can negatively impact the NPS.

2. Personalization:

Personalization in banks is more than customized marketing and sales approaches. It is the capability to use customer data to provide personalized service, information, and advice.

Banks can analyze the customer data they have to understand the needs and preferences of their customers. This way, they can tailor their services to meet customer needs, enhancing the customer experience.

Personalization can include financial advice, service recommendations, or even user interface customization.

3. Artificial Intelligence:

With AI, banks can improve and automate their customer support, making the service more efficient. By implementing AI tech like AI-powered chatbots, and AI meeting assistants banks can respond faster to customer queries improving their CX.

However, banks have to ensure that the system responds with relevant and helpful answers.

4. Proactive engagement:

Data analytics offers banks a deeper insight into their customers. For instance, they can analyze spending habits, saving patterns, credit usage, and other key financial behaviors.

Based on these insights, banks can proactively engage with customers. Instead of waiting for customers to contact them with their queries/issues, banks can anticipate customer needs and offer solutions even before the problem arises.

For example, banks can offer budgeting tips for customers who consistently spend more than their income. OR, banks could help customers saving money in low-interest accounts switch to better accounts.

In doing so, banks can provide more personalized service and financial guidance. As a result, customers can manage their finances better and will build trust and loyalty with the bank.

5. Customer Experience (CX) Design:

This is done to create a consistent, relevant, and meaningful experience at each business touchpoint. Banks should leverage their customer data to understand behavior throughout the customer journey. They can use these insights to make design changes that emphasize and enhance the customer experience.

Doing so can help reduce waiting times, simplify the process, and ensure smooth interaction at every touchpoint. Improved CX directly influences customer satisfaction and, consequently, NPS.

Ready to Elevate Your NPS? Request a demo today and leverage SurveySensum’s NPS software to guide you toward unparalleled customer loyalty and advocacy!

How to Overcome Challenges in NPS Adoption?

Implementing NPS in banking comes with its own set of challenges. Here are a few common obstacles and strategies to overcome them:

1. Understanding the Score:

Interpreting NPS can be confusing for some organizations. NPS ranges from -100 to +100, which is quite different from most other scores or ratings that range from 0 to 100 or 1 to 5.

Strategy: Ensure all stakeholders, from frontline staff to executives, know about NPS. Make them understand what NPS is, how it’s calculated, and what it means for your organization. Providing clear guidelines about the NPS interpretation can help the organization use it effectively.

2. Limited Response Rates:

Sometimes, the response rates to NPS surveys are quite low, skewing the results and making them less reliable.

Strategy: Improve your survey design and distribution. Ensure your surveys are short, easy to complete, and sent at the right time. Use an omnichannel approach to reach your customers where they prefer to engage.

3. Taking Action on Feedback:

Banks often struggle to convert the feedback received into actionable insights. This can lead to delays in addressing customer concerns, which could be damaging.

Strategy: Implement a robust system for analyzing NPS feedback. Use text analytics to understand common themes in customer comments. Prioritize actions based on the frequency and severity of the issues raised. Close the loop by contacting detractors to let them know that their feedback has been heard and acted upon.

4. Organizational Silos:

Different departments may operate in silos, making it harder to get a complete picture of the customer. This can create inconsistencies in customer experience, leading to a lower NPS.

Strategy: Encourage cross-functional collaboration. Share NPS data across all departments and use it to drive a consistent, bank-wide focus on improving the customer experience.

These are the most common challenges banks face while implementing NPS. If you are interested in learning about this, read our experts’ take on how to overcome the challenges of implementing NPS in banks.

Now, let’s explore real-world examples of NPS in banking sector.

Real-World Examples of NPS in Banking

Here is a case study of a world-renowned bank USAA, its NPS success, and what we can learn from its NPS program.

Case Study: USAA Success with NPS

The American bank USAA enjoys an NPS score of 75 with its customer-centric approach. The bank emphasizes ease-of-use and transparency in customer interactions, fostering long-term customer loyalty and satisfaction.

Some key innovations that drive USAA NPS success include enabling customers to check bank balances via text messages and providing a streamlined claims process where users can remotely upload photos and voice notes after car accidents. These technological advancements showcase USAA’s focus on reducing customer effort and addressing evolving needs.

USAA’s strategy highlights how prioritizing customer needs over technology for its own sake can set industry benchmarks in customer experience.

Lessons Learned from the Banking Industry

- Act on Feedback: High-performing banks use NPS not just as a metric but as a guide for continuous improvement. For instance, acting on customer feedback about convenience or digital accessibility can make a significant difference.

- Close the Loop: Top banks prioritize engaging with detractors and passives to resolve their concerns, converting potential detractors into loyal promoters.

- Segment Analysis: Segmenting NPS by customer demographics, products, or regions allows banks to pinpoint specific areas for improvement and customize their strategies effectively.

- Leverage Technology: Institutions leveraging AI and analytics tools to automate NPS tracking and response management see faster results in improving their scores.

Now, while NPS in banks and other financial institutions can work greatly in their favor, it is important to consider reliable NPS software for the purpose.

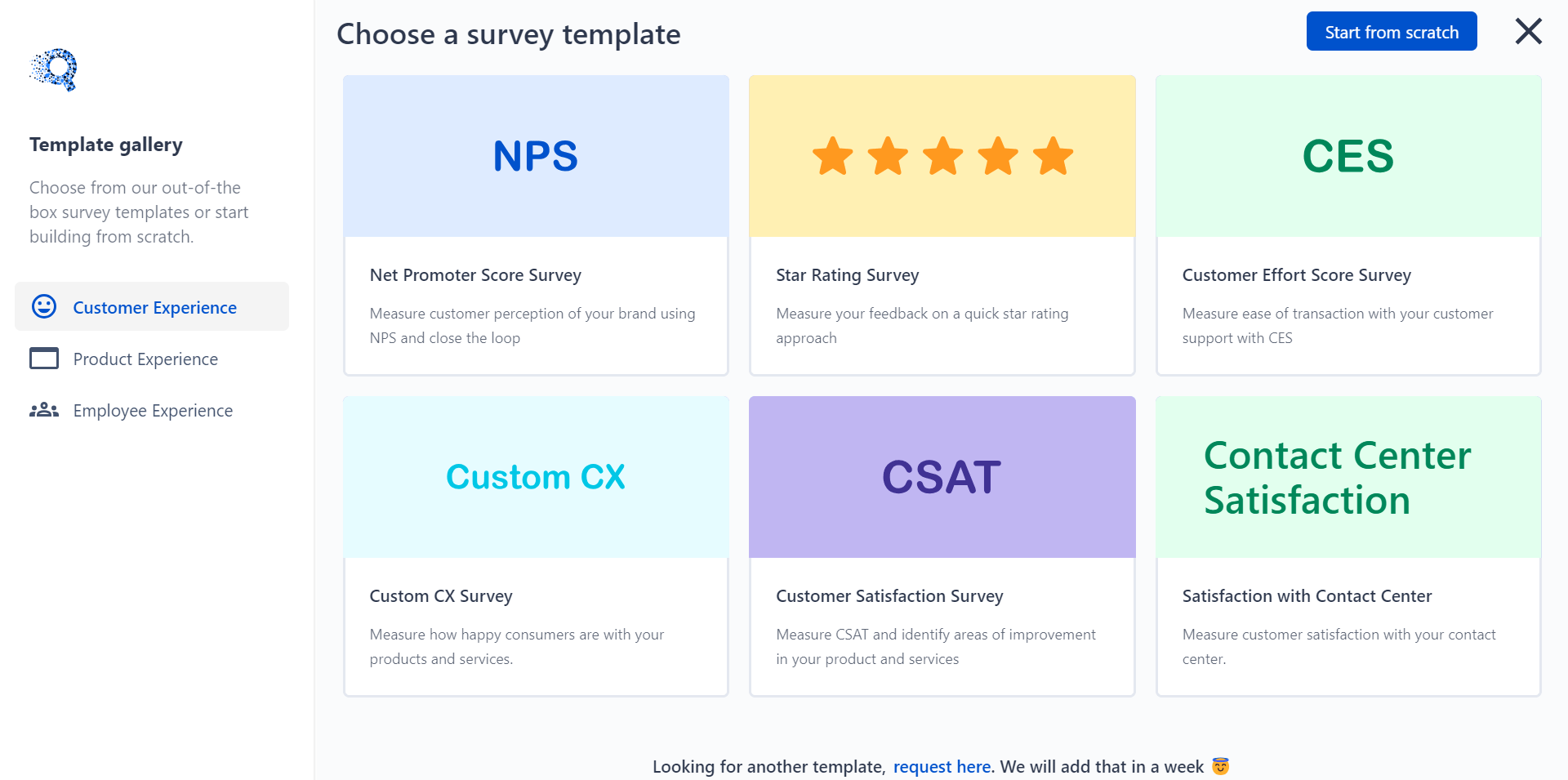

Why Choose SurveySensum for Your NPS Survey?

When selecting an NPS tool, it is essential to choose the one that best fits your financial institution.

There are many tools available in the market, and SurveySensum is one the best NPS software tools among them. SurveySensum is a top customer experience management platform. The tool is AI-powered and can not only collect feedback but also help understand the sentiment behind it. This way, it helps identify the areas that need improvement, detect trends, and ultimately enhance the CX.

It provides a wide range of features, including NPS, CSAT, CES, and employee experience. Following are some key features that set it apart from the others in the market.

- AI-Powered Analytics: Utilizes AI and ML algorithms to analyze open-text feedback and identify key themes, sentiments, and trends.

- Customization: Allows users to customize their surveys and design options to match their brand.

- Omnichannel distribution: Offers multiple channels for survey distribution to reach customers where they are comfortable.

- Real-Time Reporting: Provides real-time dashboards and reports to track all key metrics.

- Integration: Seamless integration with various third-party platforms to streamline data collection and NPS analysis.

- Feedback Management: Allows users to manage and act on the feedback received. This includes the ability to follow up with respondents.

- Multilingual Surveys: Supports survey creation in different languages. This helps businesses connect with a diverse customer base.

- Security & Compliance: Strong data security measures are in place to protect respondent data. Compliance with data privacy regulations like GDPR.

On top of this, SurveySensum offers surveys through WhatsApp. By leveraging the world’s most used messaging app, SurveySensum ensures a higher NPS response rate.

Read how Indomobil increased its survey response rate with WhatsApp surveys.

Frequently Asked Questions

Banks should focus on relationship NPS and measure NPS at regular intervals to capture evolving customer sentiment and address pain points proactively. However, transactional surveys after key customer interactions, like loan approvals or account setups, can provide immediate and actionable insights.

Yes, NPS is a powerful tool for reducing churn. By identifying detractors, banks can address dissatisfaction and resolve issues before customers leave. It also helps pinpoint loyalty drivers, enabling banks to replicate positive experiences across their customer base.

Some common mistakes banks make with NPS include lack of action, survey fatigue, misinterpretation of data, and ignoring detractors as well as passives.

Banks can improve their NPS score by streamlining digital banking services and minimizing customer effort, closing the loop by addressing detractors’ concerns promptly, and providing employee training, personalized communication, and continuous monitoring.