Only 23% of customers say they’re “very satisfied” with their experience. Meanwhile, 44% are already open to trying new brands, even if they like the one they’re with.

Once they leave, your chances of gaining them back are reduced to a slim 20% to 40%. Good isn’t good enough for customers anymore!

So, how do you know if your customers are really happy?

Will they remain loyal customers, refer customers to you, or overlook an error you make? You can’t just estimate it—you have to quantify it.

Wondering what types of metrics measure customer satisfaction?

We’ll break down the key customer satisfaction metrics that are simple to track and essential for keeping your customers happy. But before that, let us demystify what the phrase ‘customer satisfaction’ means.

What Are Customer Satisfaction Metrics?

Customer satisfaction metrics provide quantifiable insights into how well your product or service meets customer expectations at different stages of the customer journey. You can collect these data points through surveys, feedback forms, and social media interactions. These insights assist you in evaluating how well you are meeting your customers’ needs and pinpointing areas that require improvement.

Why Measuring Customer Satisfaction Metrics Are Important?

Tracking customer satisfaction metrics can help you steer your business forward. Here’s why:

- Spotting Issues Early: Tracking satisfaction helps you catch and fix problems before they escalate, keeping your service or product running smoothly.

- Building Loyalty: Understanding feedback lets you make changes that turn occasional buyers into repeat customers, strengthening their loyalty. Satisfied customers are 3–10x more likely to make repeat purchases compared to those who are only somewhat satisfied.

- Creating Brand Advocates: Happy customers become your best promoters. In fact, 72% of them do, and 92% of people trust recommendations from friends and family, according to Salesforce.

- Boosting Retention: Regular satisfaction checks help you stay aligned with customer needs, reducing the risk of losing them to competitors. A survey reveals that a 1% increase in customer satisfaction equates to 5% of the total capability.

Now that we know the ‘why,’ it is time to talk about ‘what’. What types of metrics measure customer satisfaction, and how can each provide unique insights into their experience and loyalty?

What Types of Metrics Measure Customer Satisfaction? Let’s Play Metrics Detective!

It is important to understand that various metrics give different information on how well your organization is fulfilling customer needs. But first, you need to know what types of metrics measure customer satisfaction. Here’s a quick guide to the nine main customer satisfaction metrics, when to use them, and what they reveal.

1. Net Promoter Score (NPS)

What It Is:

NPS is an industry favorite that helps assess customer loyalty by asking how likely the customers are to recommend your product or service. It gives you a sense of how interested your customers are in your brand.

Calculation:

To calculate NPS, you ask customers a single question: “On a scale of 0 to 10, how likely are you to recommend our product/service to a friend or colleague?” And categorize customers into three groups based on their responses.

- Promoters are the ones that give you a score between (9-10).

- Passives are the ones that give you a score between (7-8).

- Detractors are the ones that give you a score between (0-6).

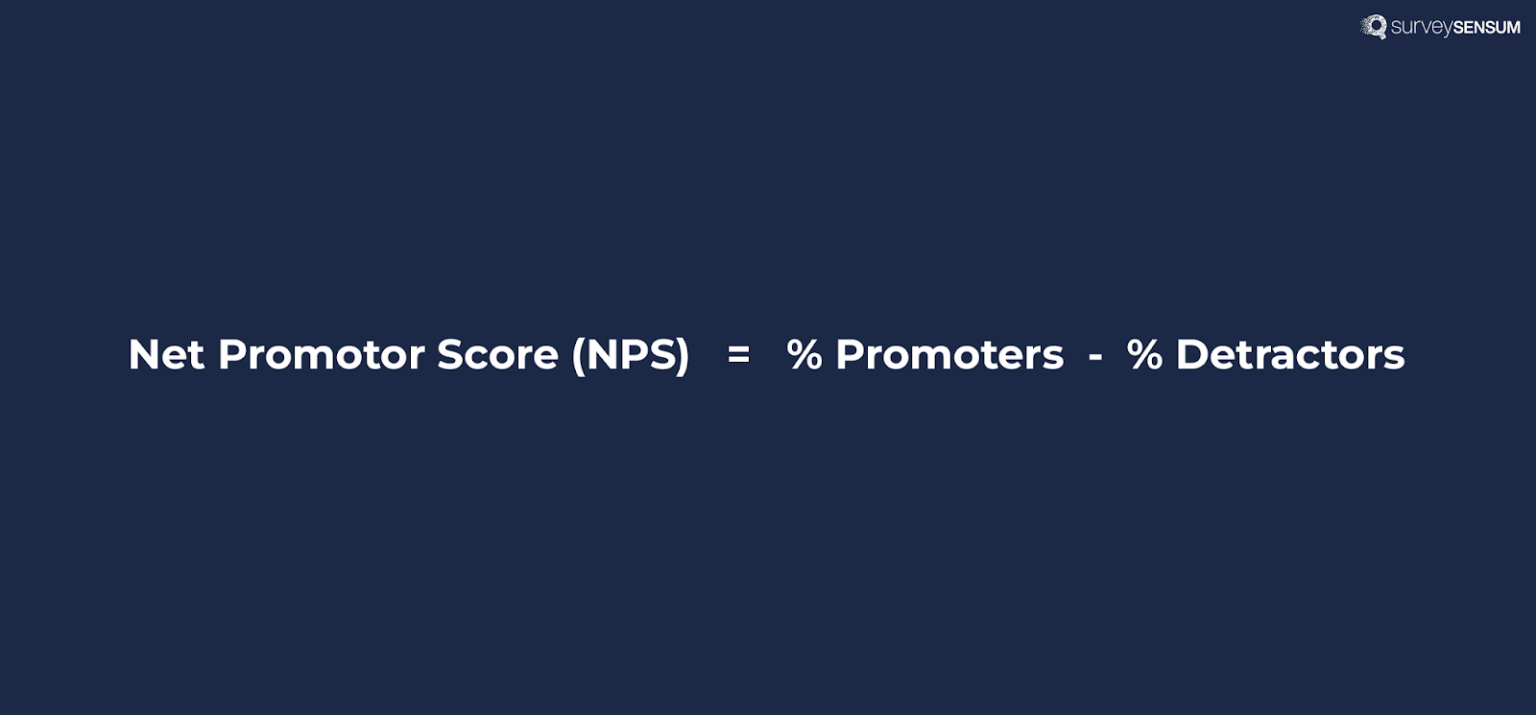

After this, you just need to subtract the percentage of detractors from the percentage of promoters, and that’s your NPS score!

To find your NPS, use this formula:

Benefits:

- Provides a direct measure of customer loyalty and sentiment towards your brand.

- Helps identify areas that require improvement based on customer complaints.

- Easier benchmarking helps you compare your business with the other businesses in the industry.

- Gives you a chance to close the loop.

Research shows that a tenfold increase in your NPS score correlates with a 3.2% increase in upsell revenue.

Is Your NPS on the Right Track?

NPS is between -100 and 100, where -100 means all detractors and 100 means all promoters, while most fall in between. A score greater than 0 is positive, as it indicates that there are more promoters than detractors.

→ Read more on what is a good NPS score for your business.

2. Customer Satisfaction Score (CSAT)

What It Is:

CSAT is employed by customers to assess their level of satisfaction with specific experiences, for instance, a purchase, product demonstration, or customer support. It captures immediate customer feedback.

Calculation:

Typically, you ask customers to rate their satisfaction on a scale of 1 to 5, with higher numbers indicating greater satisfaction. For instance, you might ask, “How satisfied are you with your recent purchase?” on a scale from 1 (very dissatisfied) to 5 (very satisfied).

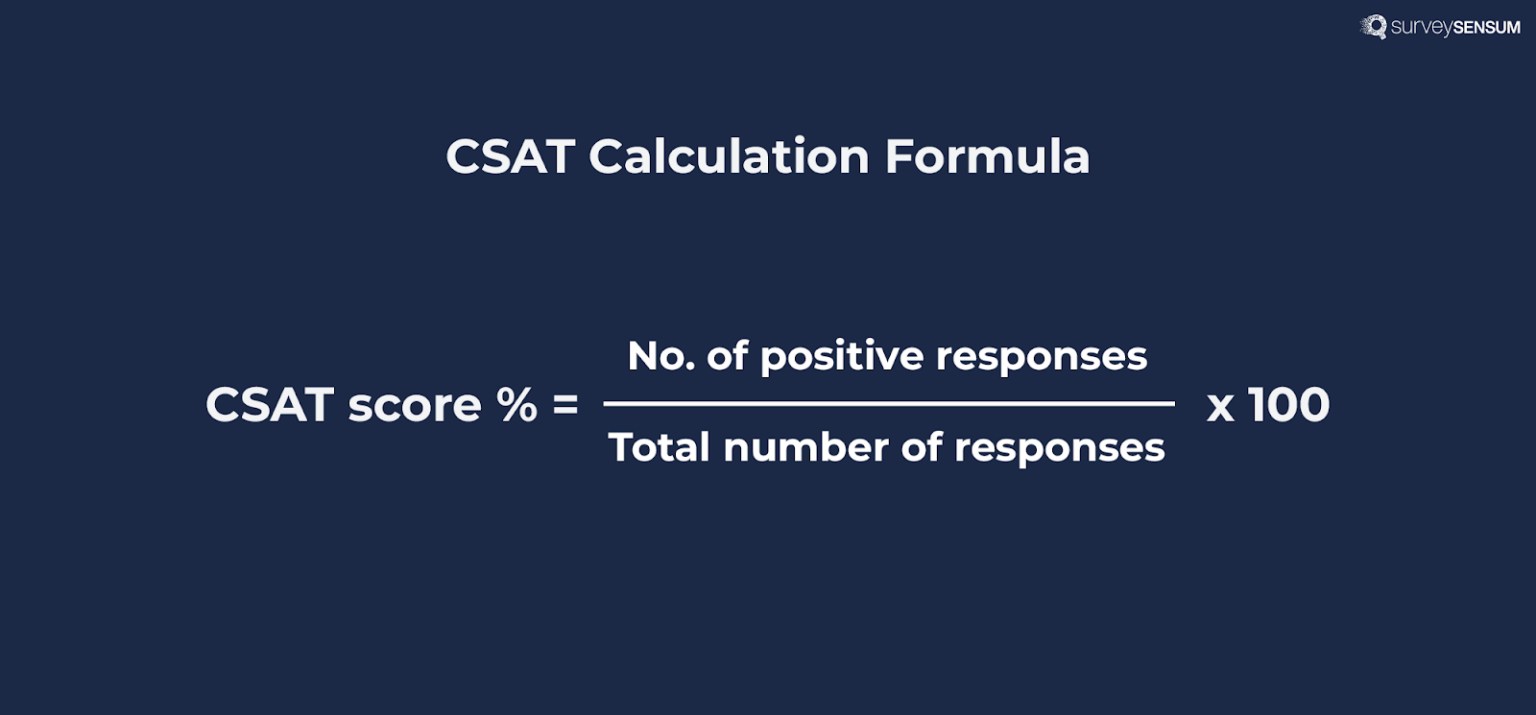

After you’ve received a response from your customers, to calculate your CSAT, first, you must determine the “satisfied” scores based on your CSAT scale. For instance, on a 1–5 scale, the satisfied scores are 4 and 5. To get the average score, divide the number of satisfied responses by the total responses you received. Multiply the average score by 100 to turn it into a percentage.

To find your CSAT, use this formula:

Benefits:

- Offers a tangible way to give feedback on certain details of the customer experience.

- Supports the assessment of effectiveness and efficiency at each touchpoint.

- More opportunities for up-sell and cross-sell.

The organizations with a higher CSAT rating have been seen to have a 12% increase in their stock prices.

Is Your CSAT on the Right Track?

Hence, many firms grade a score as very good within a range of 75% to 85%, and a score above 90% is graded as exceptional.

Of course, the number is very subjective, so expectations will vary a bit by industry and by company.

3. Customer Effort Score (CES)

What it is:

CES was launched in 2010 by the Corporate Executive Board, and what it defines is the extent of efforts that customers have to undertake while dealing with your product or service. While other metrics may focus on the results, CES is all about ease or difficulty.

Calculation:

You can ask a customer how effortless it was for him or her to accomplish a certain task; for instance, search for information or seek assistance. For example, “In your opinion, how hard or easy was it to get help from our support team? Where 1 is as simple as it can get & 7 is as complex as it gets.”

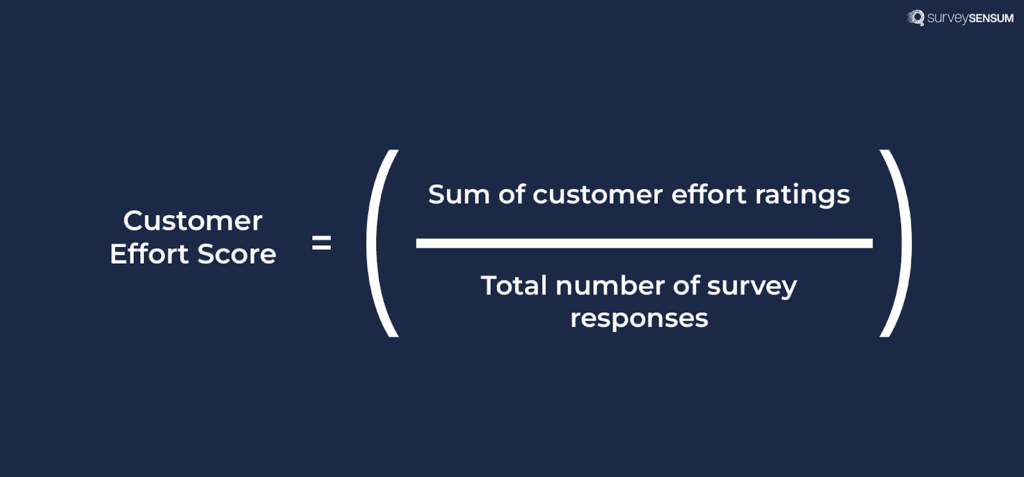

After you have your responses, calculating CES is easy. Just add up all the responses and divide by the total number of responses.

To find your CES, use this formula:

Benefits:

- Focuses on those aspects that may be problematic or challenging for the customers.

- Gives real-time information to improve workflow and eliminate bottlenecks.

- Minimizes customer service costs and reduces the load on a customer support team.

80% of businesses see CES as crucial for assessing customer service efficiency. According to a survey by Harvard Business Review, 94% of customers who had a low-effort interaction were likely to purchase the product again.

Is Your CES on the Right Track?

Your CES score ranges from 0 to 100, with higher scores indicating a smoother and more effortless customer experience. The higher your score, the smoother your customers’ brand interactions.

Since CES is relatively new, benchmarks are limited. For assessment, monitor your CES on a regular basis and observe changes in your trends.

4. Customer Churn Rate (CCR)

What It Is:

CCR measures the percentage of customers who stop using your product or service over a certain period. It is one of the primary indicators of overall dissatisfaction concerning your product or service among customers.

Calculation:

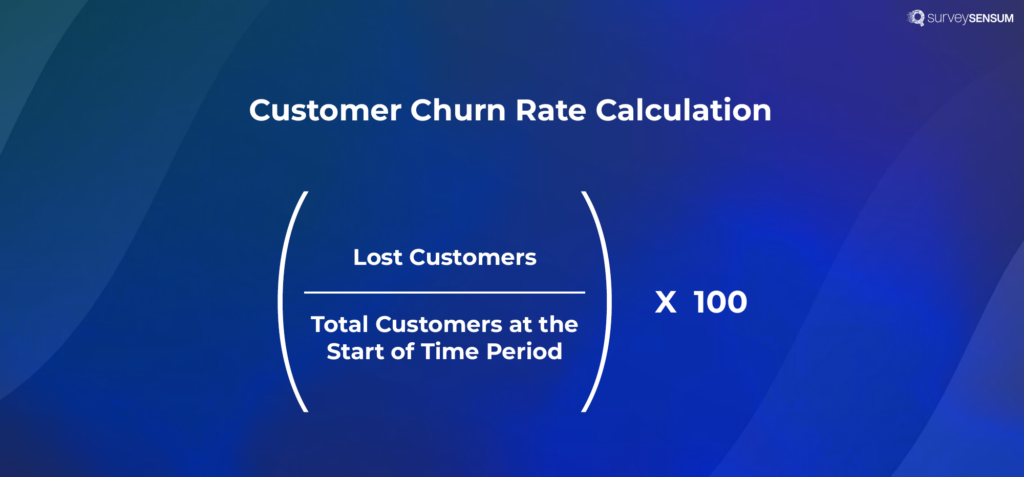

To calculate CCR, you need two things: the number of customers lost during a specific time and the total number of customers at the start of that time.

According to your preferences, you can determine CCR on a weekly, monthly, quarterly, or yearly basis using the following formula:

Benefits:

- Evaluates customer retention and dissatisfaction.

- Aids in spotting trends and potential challenges in customer experience (CX).

- Valuable for understanding the effects of any changes or enhancements.

Is Your Churn Rate Good?

When it comes to churn rate, a lower rate is preferred, with the most ideal being less than 7% in a year and less than the growth rate. High churn is undesirable for growth, meaning something is wrong with the client experience or your target customers’ segment.

5. Customer Health Score (CHS)

What It Is:

CHS determines the probability of customer loyalty to your brand. It monitors several attributes that describe customer loyalty behavior and customer churn probability. While direct metrics like satisfaction ratings give you a snapshot, CHS digs deeper by tracking patterns over time.

Calculation:

CHS considers factors like:

- How long have customers been using your product?

- How much they’re spending

- How frequently do they seek assistance?

- Are customers willing to fill out your surveys?

Steps to calculate CHS:

- Determine what the health score is going to reflect, such as churn risk and loyalty, and correlate that with your customer success objectives.

- Customer behavior metrics should be selected that show how customers are utilizing their product.

- Find out which actions done by the customers influence the health score: rewarding (e.g., login frequency) or passive (e.g., inactivity).

- Rank the impact of each action. High-impact behaviors should get higher scores, while less significant actions get lower scores.

Benefits:

- Check customer loyalty and identify those who are likely to switch.

- Ensures that customers’ satisfaction and overall involvement are well understood.

- Helps identify potential issues early.

- Allows you to focus on high-priority customers.

6. Customer Acquisition Cost (CAC)

What It Is:

CAC represents the cost of acquiring customers for the company. This range includes costs related to sales and marketing, such as bonuses, commissions, salaries, discounts, and overhead. It helps you determine whether your spending is sustainable and make adjustments to improve profitability.

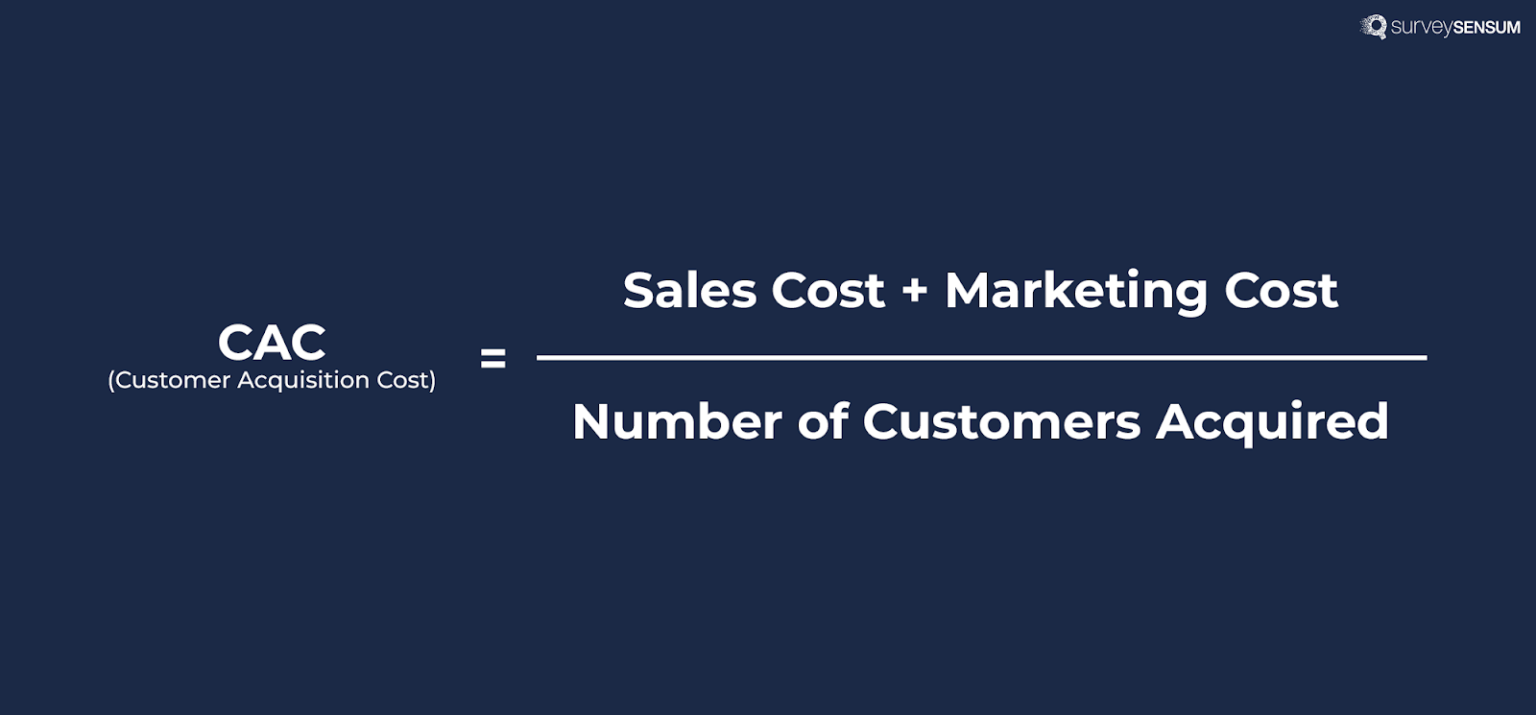

Calculation:

Decide on the frequency that you will be using to determine your customer acquisition cost, like a month, quarter, or year. Next, add all your marketing and sales expenses together and then divide that total by the number of new customers you gained.

Use the following formula to find your CAC:

Benefits:

- Work out your budget by considering your sales journey.

- Learn how to track spending for efficient use and control of expenses.

- Understand how to acquire customers at the lowest cost possible once they get into the funnel.

Is Your CAC Good?

A favorable CAC can differ widely between industries, so looking at CAC in isolation might not be very insightful. To assess if your CAC is reasonable, compare it to the Customer Lifetime Value (CLV).

7. Customer Lifetime Value (CLV)

What It Is:

CLV calculates the expected total amount of money that could be made from the customer in the entire course of the relationship with the company. It is an important measure of long-term profitability and useful for maintaining customer loyalty.

Calculation:

CLV has a complex nature because it incorporates factors such as products, costs, frequency of purchase, and quantity. Here are the steps to begin the calculation:

- Calculate the average purchase value by dividing total revenue by the number of transactions.

- Determine purchase frequency to understand buying behavior.

- Multiply the average purchase value by the purchase frequency to find the average customer value.

- Identify the average customer lifespan to see how long customers stay engaged.

- Calculate the CLV by multiplying the average customer value by the average lifespan.

Use the following formula to find your CLV:

Benefits:

- Better CLV can increase revenue over time.

- Identify issues to boost customer loyalty and retention.

- Target your ideal customers.

- Accurate predictions about future cash flow.

Did you know that 76% of companies consider CLV a key concept for their business? It’s clear that understanding CLV is crucial for many organizations.

Is Your CLV Good?

A good CLV is much higher than the CAC, so the cost of acquiring customers equals their future revenues. Compare CLV against industry benchmarks to gauge whether your strategies are effective in fostering customer loyalty and maximizing revenue.

8. Customer Retention Rate (CRR)

What It Is:

CRR gives the percentage of repeat business from customers within a given period, which is an important financial ratio. This is yet another powerful metric that reveals the extent of customer retention and their level of satisfaction.

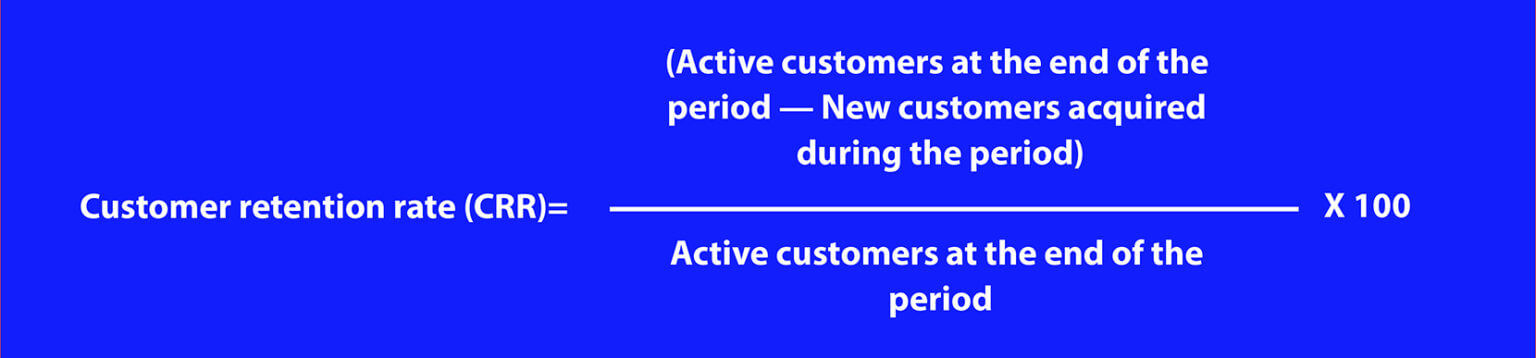

Calculation:

To calculate CRR, select the period for which the report will be made. For fast-growing businesses, more frequent tracking (weekly or monthly) is ideal, while smaller businesses can track semi-annually or annually.

Next, compare the number of customers at the start of a specific period to the number at the end, excluding any new customers. Then, subtract the number of new customers acquired during that time from the total at the end. Divide this result by the initial number of customers, then multiply by 100 to express it as a percentage.

Use the following formula to find your CRR:

Benefits:

- Uncovers areas to improve loyalty and retention.

- Reveals how consistently customers value your product over time.

- Helps focus on targeting the most valuable customers.

Increasing customer retention by just 5% can boost profitability by 25% to 95%. Yet, 44% of businesses don’t measure retention, potentially missing these gains.

Is Your CRR Good?

Generally, even top companies often don’t exceed a 94% CRR. Customers with higher CRR are usually more loyal; however, the level of CRR that can be considered good depends on the particular industry. It is recommended to achieve not less than 85% of the average CRR for your industry to ensure your business remains scalable.

9. Five-Star Ratings

What It Is:

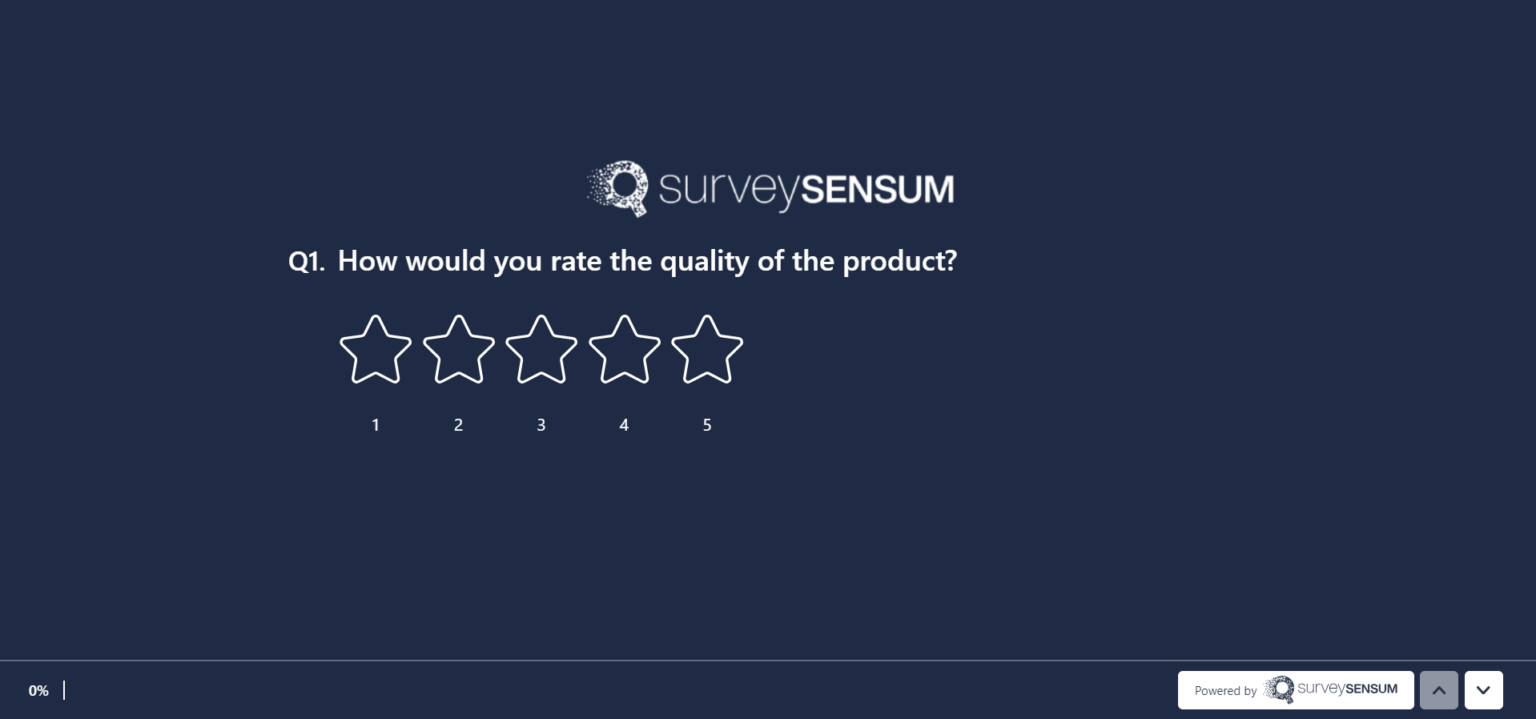

Five-star ratings are a straightforward method in which customers rate their experience on a scale of 1 to 5 stars. You can best use five-star ratings for quick, visual customer feedback, particularly when monitoring online product or service reviews. You should not solely rely on it for detailed insights, but it’s ideal for measuring general customer sentiment.

Calculation:

It’s based on one question: How would you rate your recent (experience/product/service)?

To calculate the 5-star score, divide the total number of stars by the number of responses.

Benefits:

- Provides a straightforward and easily understandable rating system.

- Easier for analysis.

- Useful as social proof across marketing channels.

Specifically, 93% of customers check out online reviews before making a purchase, and 97% say these reviews influence their buying decisions.

Tools for Tracking Customer Service Metrics

Keeping track of every customer service metric manually is nearly impossible. Luckily, some tools automate this for you, making it simple to capture, process, and improve customer service performance.

CRM Tools

A CRM consolidates all customers’ information; therefore, the support agents can focus on the most relevant aspects of the client’s experience. It also helps in acquiring and analyzing data on its own, without having to incur a lot of time on this process. Moreover, it allows managers to set goals and control the result of the team’s work in the CRM platforms.

Survey Tools

Survey tools improve the development of surveys, the distribution of surveys, as well as the evaluation of surveys. It minimizes mistakes and also makes it possible for the respondents to complete the surveys on various devices. Tools like SurveySensum let you gather feedback through channels, leverage survey templates, and app integrations.

With SurveySensum’s ready-to-go templates, you can roll out NPS, CSAT, and CES surveys in the language of your choice in just 5 minutes. Discover key insights, boost customer experiences, and elevate satisfaction

Wrapping Up

“There is a big difference between a satisfied customer and a loyal customer. Never settle for ‘satisfied’.” – Shep Hyken

Satisfaction is just the start. To build loyalty, you need to keep the conversation going with regular surveys and feedback sessions. Use both data (like NPS) and open-ended feedback to get the full picture, and show customers you’re acting on their input. Nothing says, “We care,” like real changes driven by their input.

To streamline and enhance this process, SurveySensum is a reliable tool. By using text analysis on open-ended feedback, you can navigate through the fog of customer friction to uncover the true obstacles in your path. Share those outcomes with your customers, close the loop, and watch loyalty grow.